This Week in Episodic Pivots May 5, 2024

We're adding a new company to the portfolio

Did Apple Just Save the Market?

Maybe… Investors cheered their earnings as they weren’t as bad as expected. Apple ( AAPL 0.00%↑ ) beat sales and profit estimates and announced a $110 billion share buyback – its biggest to date. On top of that, sales in China held up better than people thought. And their high-margin services revenue grew 11% this year. All in all, it was a good quarter.

That’s why the stock price soared 6% on Friday. And it got prices above most of the technical resistance that had been pushing it down.

This is a chart that looks like it’s going higher. I’m not making it an official recommendation, but it’s probably a good place to put some extra money right now.

And on Friday we also got some weaker than expected jobs numbers. Now that sounds bad, but we have to remember that weak economic data means the Fed will likely cut rates sooner. So that really stoked the animal spirits and helped push the market even further Friday.

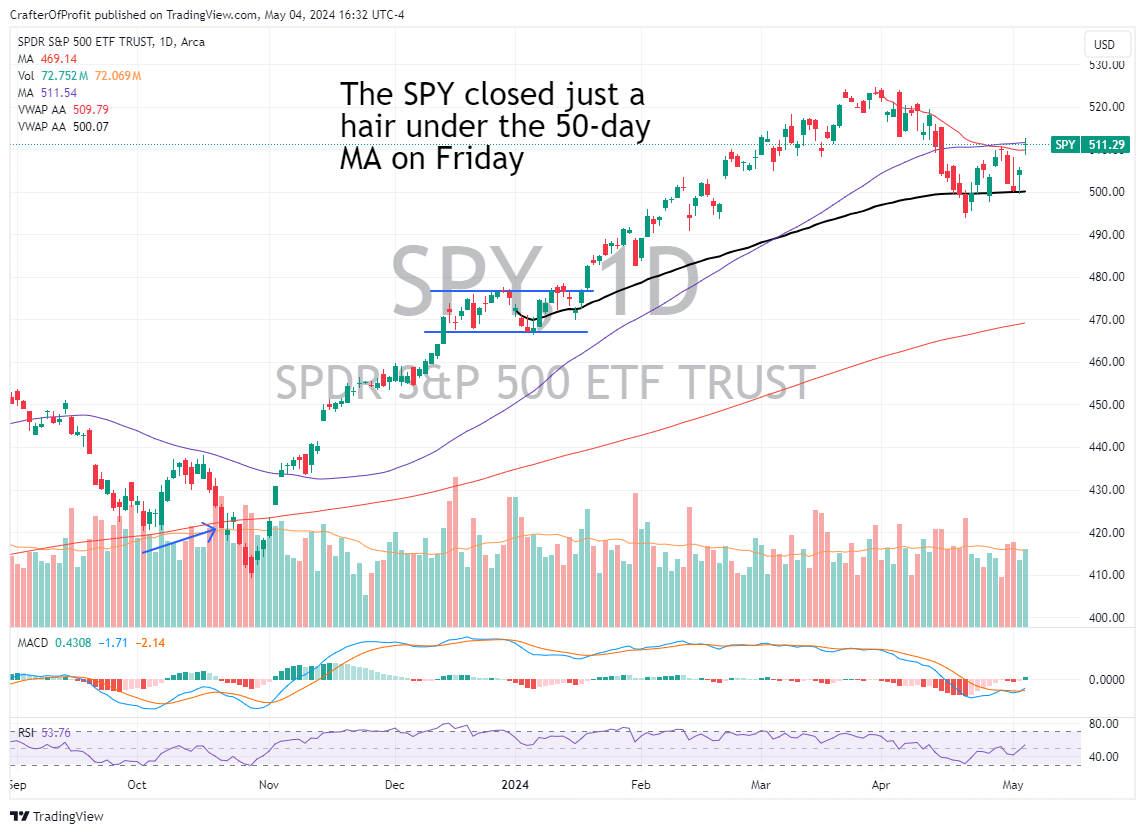

I will say that this is all very constructive. But we’re still not quite out of the woods yet. The major indices are still below their 50-day moving averages. That means the market still doesn’t have strong institutional support.

This remains the case for important leading sectors such and semiconductors and financials. They are struggling to reclaim this important technical level.

Now next week, I think what will cause the most pain will be a move above the 50-day on Monday. This will suck in all the trend followers and people who wait for this signal to be invested. Then maybe a turnaround Tuesday scenario which would send the market lower.

Remember, most of the time the market does what will hurt the most people. So don’t be one of those people.

But with that being said, the Fed also did a solid for the market this past week. We all know that Fed Chairman Jerome Powell said they aren’t raising rates anymore. That’s good. But what many missed was that he said he was going to slow the pace of quantitative tightening (QT) from a maximum of $65 billion a month to $20 billion. That means the Fed will be able to keep a bigger balance sheet and also keep long-term rates lower. That is bullish for equities.

Knowing When to Trade Is Just as Important as Knowing What to Trade

I would classify us as swing traders. And for our trades to be the most successful, we want to be trading along with a rising market. That helps increase the odds we are profitable. And when the market pauses like it has the past couple of months, we should slow down.

That’s why I haven’t recommended many new trades lately. It’s been choppy and we are best off just raising cash. So that’s what we’ve done.

If you want to trade in this environment, you need to be surgical. Either day trade or take profits after a couple of days. Not many stocks are making long, sustained moves. And the ones that are, aren’t the tech stocks that have worked the past year or so. It’s more like industrials and up until last week, energy that was moving higher.

And right now, we only have one position in the portfolio. That’s Tandem Diabetes (TNDM 0.00%↑ ). They just reported earnings Thursday evening as well. And they crushed it. And we’re now up 49% in the name. I think we have further to go. But that said, let’s adjust our stop to $36 to protect our profits.

I am going to add another position to the portfolio this week. But we’ll have a tight stop on it just in case the market turns.

First Solar ( FSLR 0.00%↑ )

This solar company has been a standout in the industry the past couple of months. And then after its earnings report Wednesday evening, the stock soared higher. And then had a follow through day on Friday. As we can see in the chart below, the stock broke to new highs this year.

And this two day move was on extreme volume. Making it likely big investors were trying to buy shares of this breakout stock. So we’re going to follow them in.

Buy shares on Monday and then we’ll use a tight stop of $178. This is worth taking a flier on, but we don’t want to be around if this is a false breakout.

Happy Investing!