This Week in Episodic Pivots: May 7, 2023

More setups ahead

Banks are failing and the Federal Reserve isn’t helping.

That’s about all we need to know about the markets last week. More comprehensive bank crisis analysis can be read at all major media outlets. My opinion is that this isn’t over, but that remains to be seen.

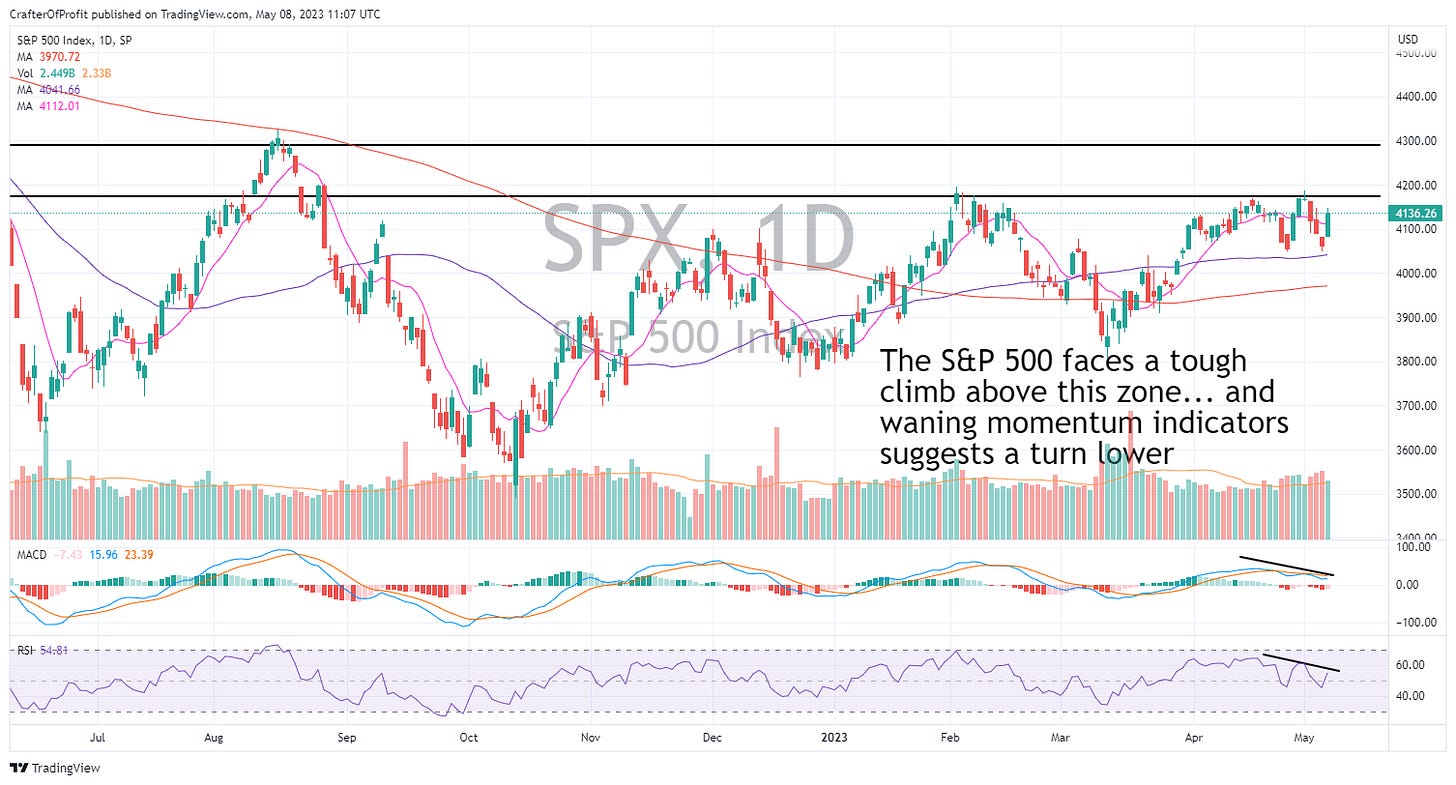

This week we’ll look for some calm in the markets. But with the S&P 500 approaching its resistance zone of 4,200 – 4,300 it will likely be choppy. It doesn’t help that its momentum indicators are pulling back too.

I would actually expect the futures to be up big time this morning as PacWest (PACW) soared about 50% pre-market as it announced business was good. But there’s more to the economy than just the banking crisis… So we’ll watch things carefully. And we’ve got a couple more positions to add to the portfolio this week.

Portfolio Update

Last week we got stopped out of two positions for losses. Western Alliance Bancorp ( $WAL ) was swept up in the regional bank sell-off. And it was a wild ride. But we should have missed the worst of it by closely following our stops. If anyone missed the stop, the price jumped back to where we got stopped out and wouldn’t be harmed by selling this morning.

And BigBear.AI ( $BBAI) failed to find any momentum for our trade. And we got stopped out of that one was well.

It wasn’t all bad news. Allogene ( $ALLO) performed strongly last week. It’s progressing nicely. They saw $52,000 of collaboration revenue which beat the expected $41,600. It’s still a small company, but that’s a good start.

ALLO surged to $6.60 last week. But many analysts don’t think it’ll stop there. JMP Securities as a $15 price target and HC Wainwright believe ALLO is a $23 stock. And on that note, we’ll update our stop to the 50-day moving average. And that will guarantee us a profit in this position.

Now let’s get onto the new positions.

American Axle & Manufacturing ( $AXL)

This is a good ol’ fashioned American company. It supplies driveline and drivetrain system for cars and small trucks. This a tough business, but AXL just showed some strength in its recent earnings report.

They beat on the adjusted EBITDA numbers by nearly breaking even on the quarter. And they reiterated their guidance for the remained of the year. That guidance includes healthy free cash flow of around $260 million.

And this strength happens as AXL traded near its 52-week low of $6.50. And it appears it is ready to bounce higher off this level as it has done 3 times in the past year.

We’ll use $6.50 as a hard stop to begin with on this position.

Accel Entertainment ( $ACEL)

Accel is a gaming company that offers slot machines and amusement equipment to retail establishments.

And gambling is back. They beat their earnings estimates last week. It blew through all resistance levels, and then went back and retested the level. And bounced higher. So that’s a strong chart pattern.

We’ll use a hard stop of $8.50 to begin with as well.

And that’s all for this week.

Happy Investing!