This Week in Episodic Pivots: March 26, 2023

We're beginning to tiptoe back into the market.

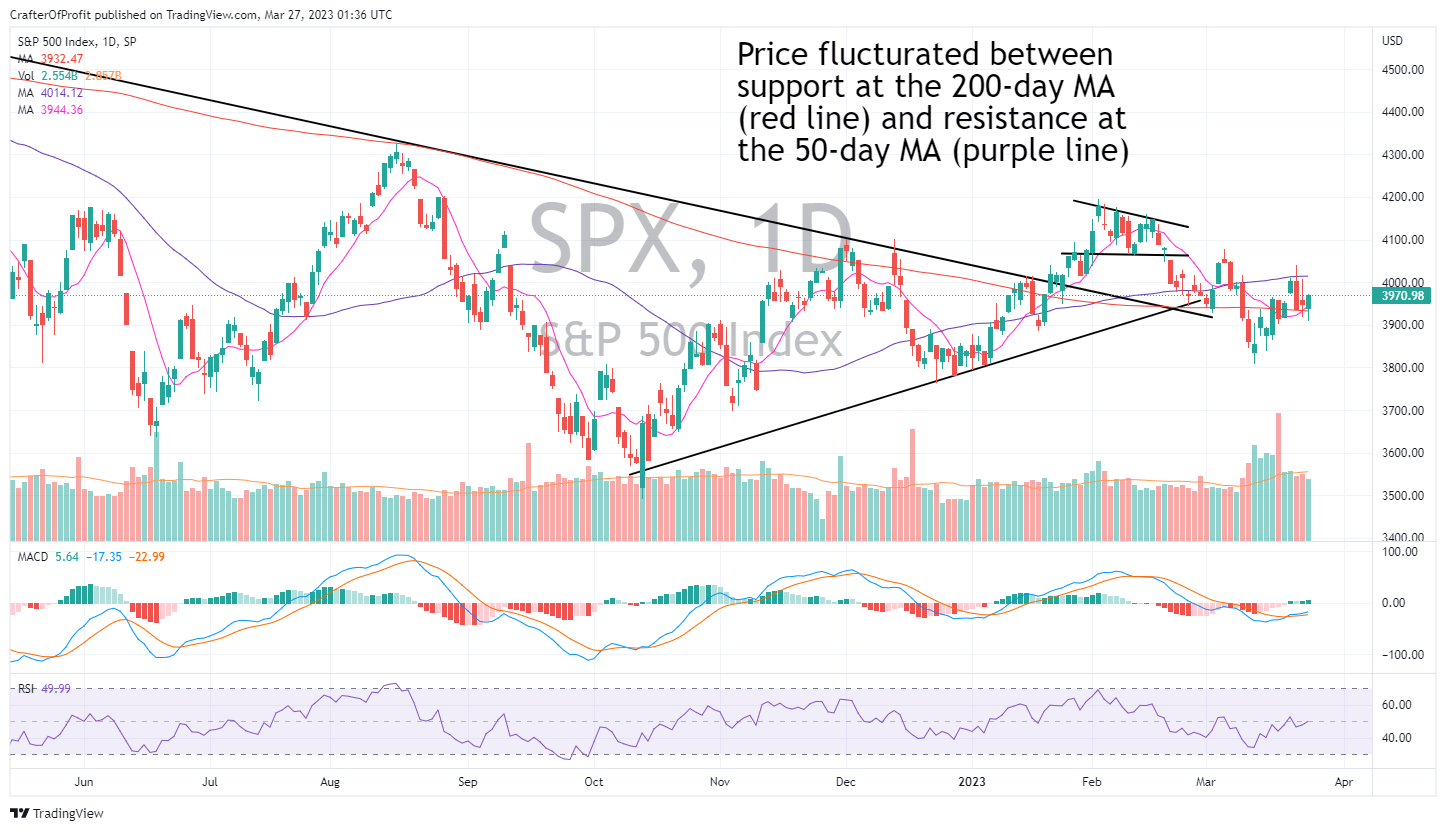

The market is in a tug of war. It’s oscillating between the support of the 200-day moving and the resistance of the 50-day MA.

Which way this market breaks will tell us what market participants believe will happen with this financial crisis.

So far, it’s pretty minor. Only 3 casualties. And it looks like First Citizen’s may be picking up the pieces of Silicon Valley Bancorp this weekend. We’ll see.

If so, we could see the market move on from this hiccup.

But let’s not get complacent. Bear Stearns failed in March of 2008 – six months before Lehman Brothers failed. And when things really started to get interesting with the financial crisis.

Six months is an eternity in the market. And would give us plenty of opportunities to profit.

And that’s what we plan to do. And this week we’ll start to tip toe back into the market with two new positions.

Renew Energy (RNW)

Renew Energy ( RNW 0.00%↑ ) focuses on developing wind, solar, and hydro energy projects for customers in India.

India is one of the most densely populated countries in the world… And is plagued by high levels of smog. So renewable energy would go a long way to cleaning their air and reducing CO2 emissions into Earth’s atmosphere.

In fact, India has plans to more than triple its renewable energy generation the remainder of the decade.

The company is still in its growth phase and remains unprofitable on a net income and free cash flow basis. But that may be changing for its 2024 fiscal year which end on March 31, 2024.

And this shift to profitability has caught the attention of its majority owner, the Canada Pension Plan. The fund already owns 51.6% of the company. And the board of the fund is discussing a tender offer for the remaining shares.

It’s likely being public is an unnecessary distraction for the firm. The share prices have not performed well the past few months. Investors are uncertain if they RNW will need to raise additional fund before it turns profitable.

But an acquisitions by the fund will solve that problem. And hand investors a quick gain.

Now it’s worth noting that this is based on rumors. Nothing is confirmed yet. So there remains a bit of risk in this position. But even without the buyout, the firm has great positioning in a leading renewable energy market.

We’ll enter the position tomorrow and then set a hard stop at $4.50 for now.

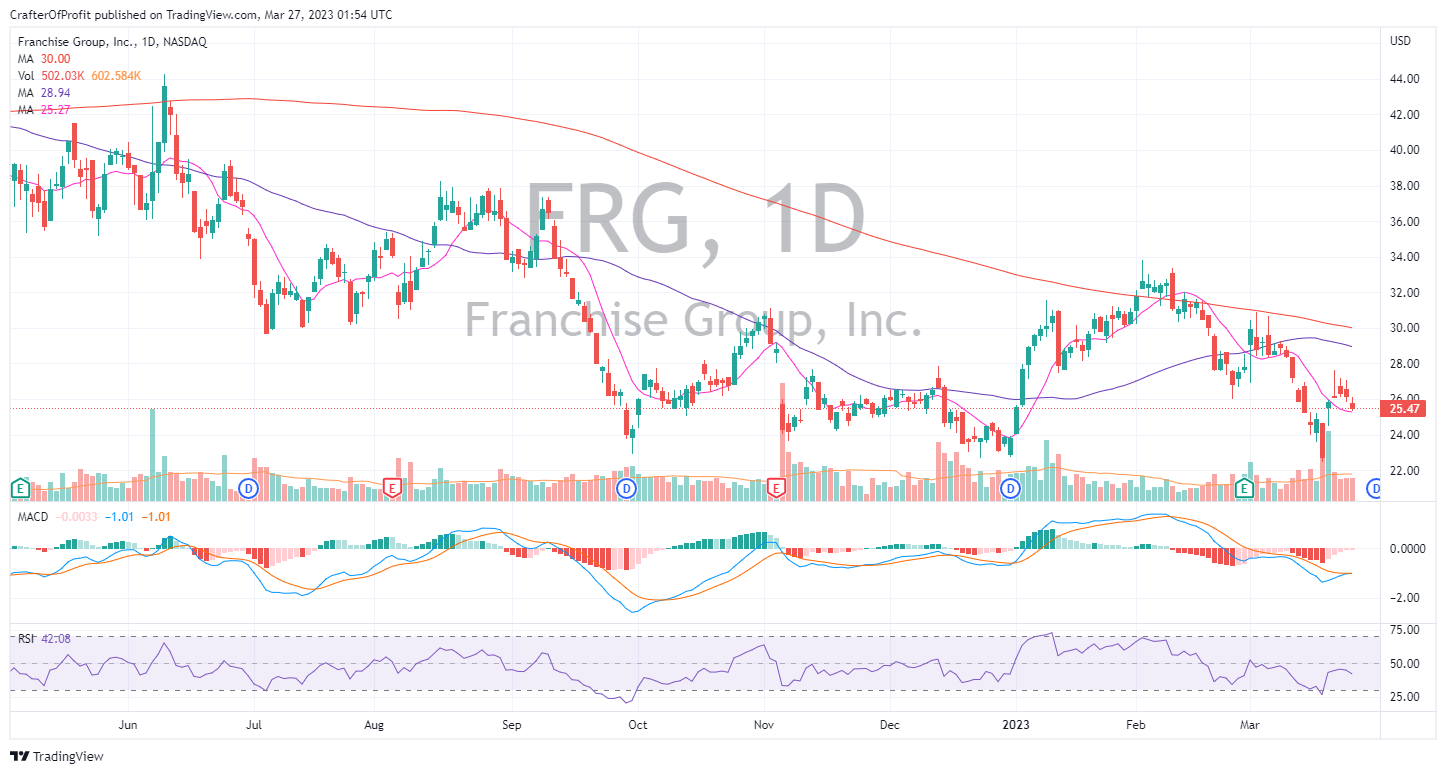

Franchise Group (FRG)

And we have another buyout candidate. This one is Franchise Group ( FRG 0.00%↑ ). This company owns a collection of brands and stores including Pet Supplies Plus, American Freight, The Vitamin Shoppe, Badcock Home Furniture, and more.

And last week they received an unsolicited bid, from an unknown source, for $30.

That’s 15% higher than Friday’s close. But there’s more potential upside.

The board is taking this bid seriously… But they wonder if there are other offers out there. So they reached out to Oppenheimer to help them see if there are any more bidders out there.

And there very well could be. The company currently trades at just 11x EV/EBITDA. That’s a really cheap level. Especially considering the company is projected to increase EBITDA over 10% a year the next couple years.

We could really see a bidder come in at $40 and they’d still be getting a great deal on a business with many great brands.

We’ll enter this position tomorrow as well. And we’ll use a hard stop at $22.

And we should still be in our remaining positions. There were no new sales last week. That means we are still in WWE, TSLA, AMEH, and KTOS.

Until next week, happy investing!