This Week in Episodic Pivots March 17, 2024

Tread carefully this week

Is Powell about to drop a bomb on the markets during the FOMC meeting at 2:30 on Wednesday afternoon? There’s a good chance. Let me tell you why.

Long-term readers know that we have been in the “higher for longer” camp regarding interest rates for a long time now. We haven’t wavered in our thoughts there. What has surprised me though is the resiliency of the economy in the face of these higher interest rates.

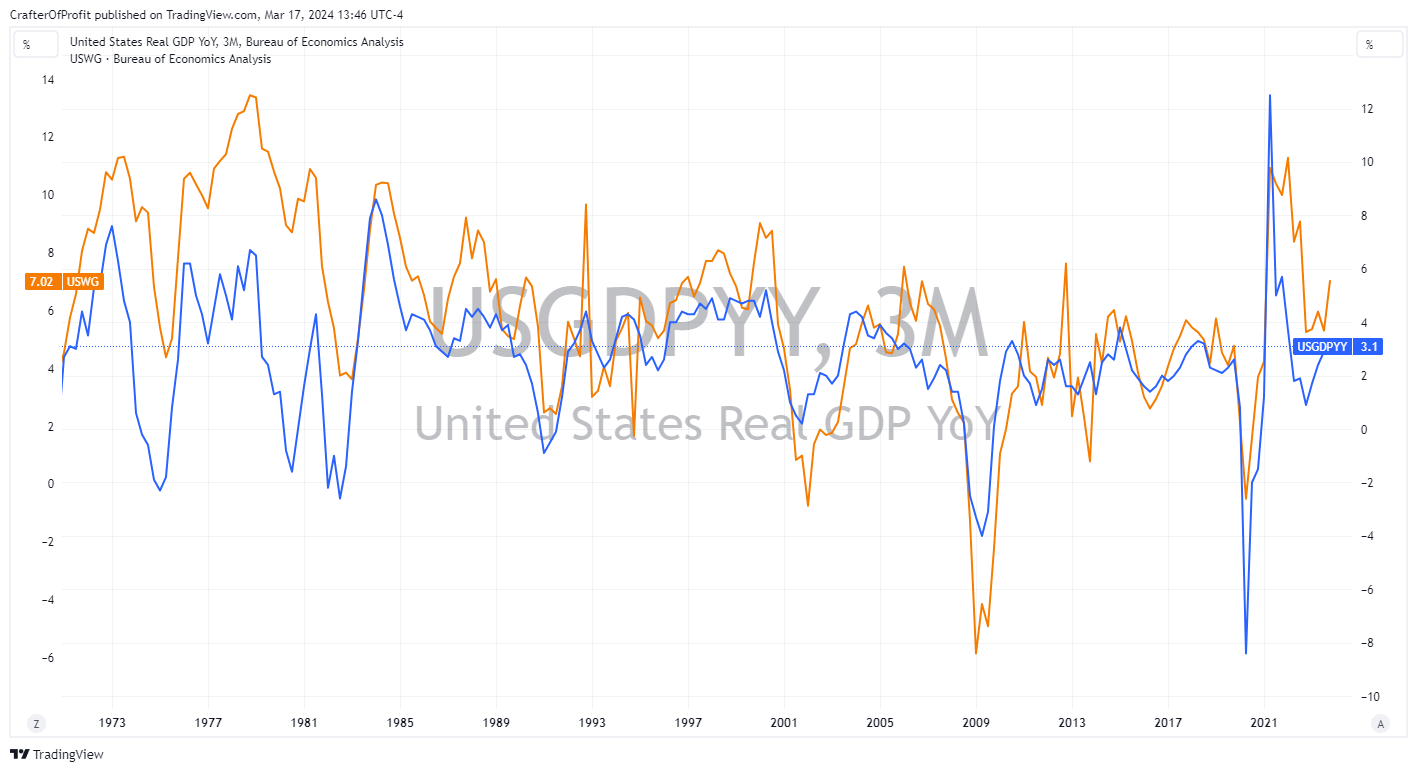

The facts show that the economy is strong. We can see in the chart below that Real GDP (blue line) currently sits at 3.1% annual growth – or about average. And then we can see wage growth (orange line) is ticking up to about 5.5% annual growth.

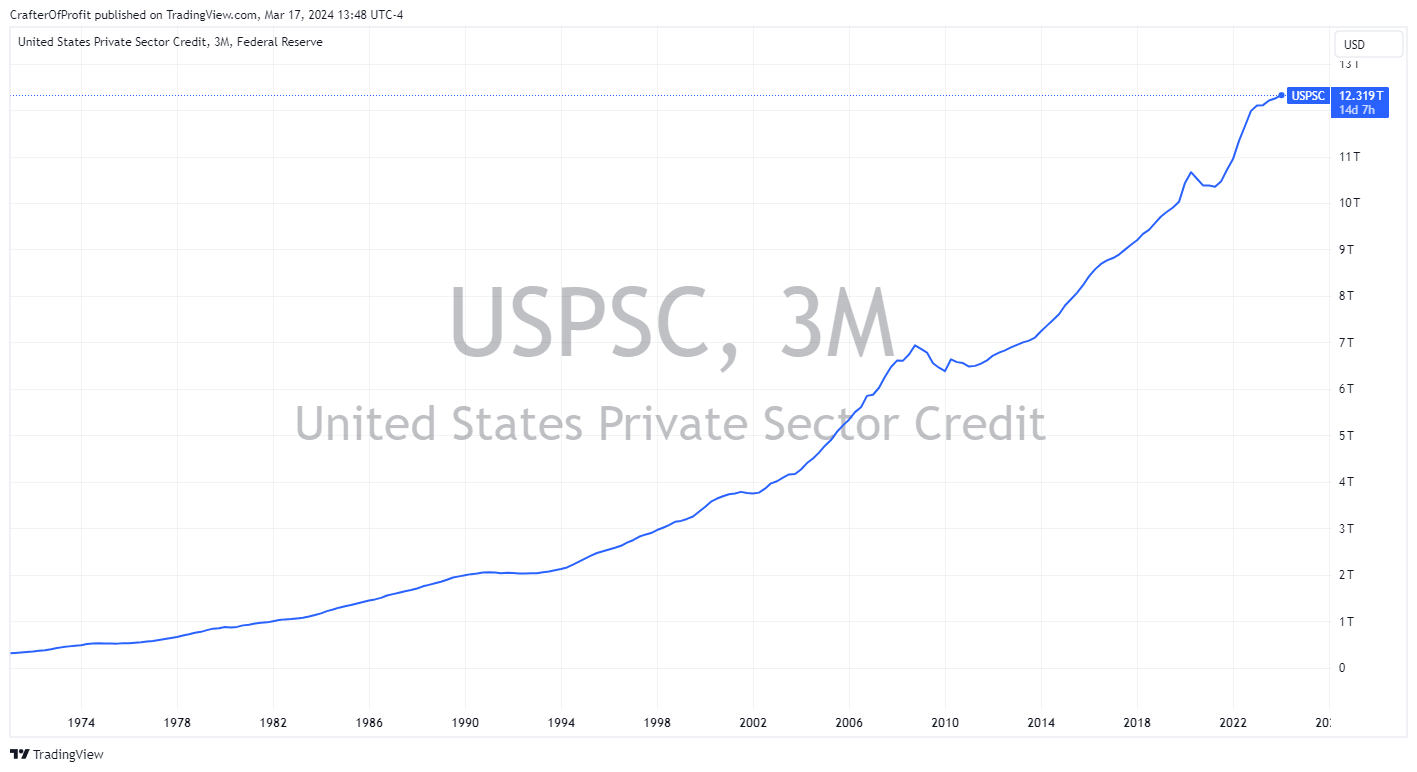

And U.S. private sector credit continues making new highs. Now US businesses and citizens have over $12.3 trillion in credit issued to them. That’s a staggering amount of credit, but as long as this continues rising, we’ll continue to see a strong economy.

This economic strength is likely to lead to inflation remaining higher than the Fed’s 2% target. We saw this last week as both CPI and PPI numbers showed a slight uptick in prices in both measures. And I think the market is starting to catch on to this.

Recently gold went on a massive, 18% move higher since bottom in October. Gold, being a physical asset, tends to rise in inflationary periods. Bitcoin has gone berserk, climbing about 140% since that time. Like gold, Bitcoin is considered a store of value by many.

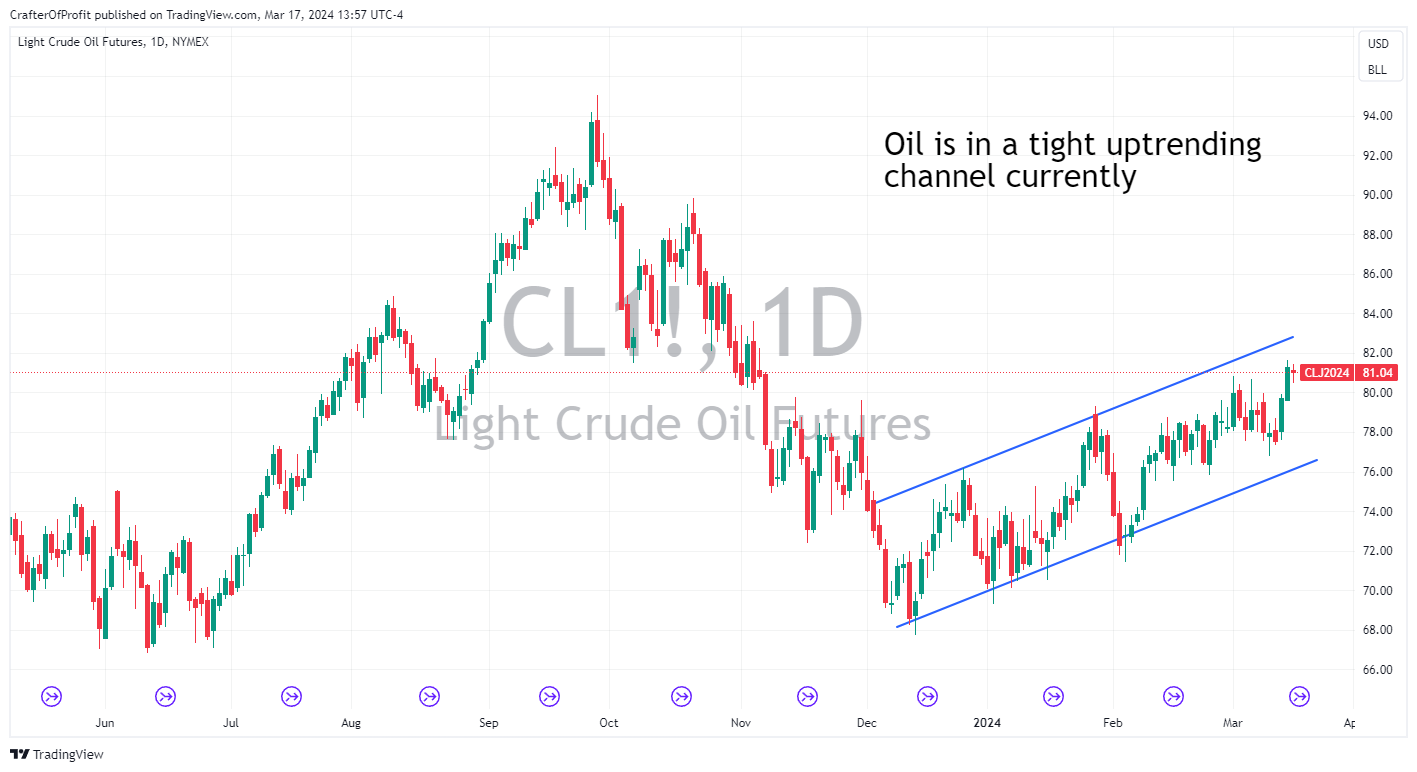

But more importantly, for the CPI and PPI weightings, crude oil has caught a bid this year.

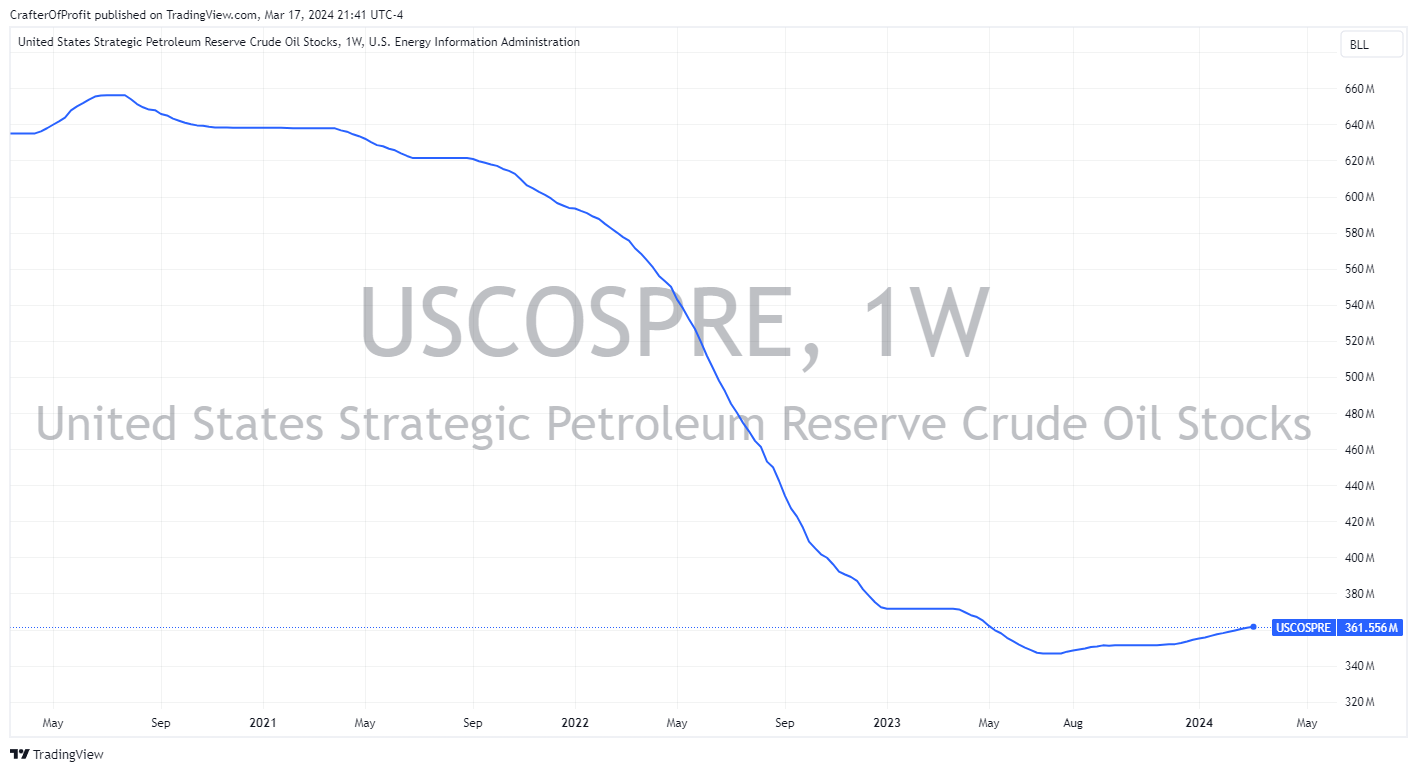

This is likely to continue as well. One big reason for that, is that the United States is finally buying oil to restock the strategic petroleum reserves. The price of oil was brought down as the SPR was tapped a couple of years ago. And as we can see below, America is working on restocking the reserve. This should create a consistent bid on the price of oil.

So with inflation remaining high and the economy strong, I think we might see Powell walk back some of the talk of rate hikes. That will impact the valuation of companies… When interest rates are low, the valuation multiples of stocks tend to rise. But higher interest rates tend to lead to lower valuations. And as we can see in the chart below, valuation multiples haven’t fallen as interest rate expectations increased.

This chart is a bit difficult to read, but if the valuation multiples do contract in lockstep with the rates we could see the market drop a quick 10% - 15%. That is not unreasonable if higher interest rates appear to be around the corner.

So that is why I’m a bit worried. But I’ve been worried a lot lately and the market keeps moving higher. There’s no point in telling the market what it should do though. We’re just going to keep with the trend and keep holding stocks that are going up.

We have one new addition this week. That is…

Valero Energy ( VLO 0.00%↑ )

Valero’s main business in refining oil into gas. And business must be booming. At least that’s what we’re seeing in the charts.

As you can see in the chart below, price had remained in a steady uptrend for the past couple of years. I know we don’t often look at weekly charts here, but now price broke above the resistance line of the channel. I believe that line will become the new support line. And that leaves VLO to go much higher.

Let’s initiate a position on Monday morning and we’ll use the yearly anchored VWAP as our stop – it sits at $140 right now.

Portfolio Update

Last week we sold PagerDuty (PD 0.00%↑ ) for a loss after a disappointing earnings report. I booked a 20% loss on that one.

Watch AEVA 0.00%↑ closely this next week. It’s sitting right at support at the 200-day moving average – which is also our stop. They had a great earnings report which sent the stock higher, but then it retreated after the company announced it was doing a 5-to-1 reverse split. One day this week, you’ll see the price of AEVA go up to $5… And you’ll notice the number of shares you hold go down 80%. That’s a reverse split. Nothing has changed with your ownership percentage of the company, it’s more of an accounting adjustment. But investors typically don’t like reverse splits, which sent the shares lower. But after this is done, I believe AEVA will make back its gains.

We’re going to update our stop on GOSS 0.00%↑ to the yearly AVWAP as well. Right now that sits at $1.20.

Hold tight onto the other three positions – SGH 0.00%↑ , HOG 0.00%↑ , and TNDM 0.00%↑ .

Happy Investing!