This Week in Episodic Pivots March 10, 2024

Two new positions this week

Hello traders. Sorry for the delay in getting the letter out. Let’s get right into things.

The market continues higher. And we’re not going to fight the trend… We should still be hanging onto our long positions – many of which are performing nicely.

Now I’ve heard talk about Friday being a reversal point in the market. Maybe, but as you can see in the chart below the last three big reversal days in the market were quickly bought up – with the market shortly making new highs shortly after.

This is why we’ve stayed long these past months. The market has just grinded higher.

There is one difference that worries me right now. And that is the huge reversal in leading semiconductor names like Nvidia ( NVDA 0.00%↑ ) and Super Micro Computer ( SMCI 0.00%↑ ).

Here’s a chart of NVDA. You’ll see it has a huge bearish engulfing candle and enormous volume. More shares traded Friday than the day after its earnings report. And if we see another down day Monday, it could signal that semis – and by extension the market – have reached a short-term top.

The blue lines in the chart show a few potential support levels if NVDA keeps falling. It’s very possible that NVDA pulls back to the blue line at $683 which would close the gap it formed from its earnings release. That would be an astounding 30%+ pullback. If that happens, I imagine the overall market would pull back.

That’s something to keep an eye on.

But other factors continue to look bullish for the markets. Mainly bitcoin’s resilience shows that the risk on mantra still reigns strong with traders. This is a chart that look like it wants to break higher. Everyt dip is bought and bought strong. And right now it just looks like the market is churning through the supply at $70k. I think those sellers are about to get exhausted and then bitcoin will break through. And probably go to $100k in short order.

The inflows in the new physical bitcoin ETFs have been much higher than expected. And Michael Saylor is in the process of raising $700 million in convertible notes to buy up more bitcoin. The demand for bitcoin appears to be increasing into its halving event next month.

Bitcoin is a great proxy for whether investors are looking to take on risk. If it keeps rising, I believe the markets will follow.

We also see the dollar index looking like it wants to roll over. A weaker dollar usually leads to higher stock prices. So that will also be a boost for the market.

So with that, let’s add a couple of positions to our portfolio.

Tandem Diabetes Care ( TNDM 0.00%↑ )

Tandem is known for its insulin pumps to help people with Type I diabetes administer insulin automatically. This in combination with a continuous glucose monitoring system, provides an easy way keep insulin levels in their desired range.

Tandem got beaten down last year as the market believed that Ozempic and Wegovy fat loss drugs would diminish the number of people with diabetes. While being overweight is a risk factor for developing diabetes, it’s usually Type II diabetes that people develop. Tandem specializes in Type I (although they have plans to help those struggling with Type II eventually).

So the stock sold off hard but is beginning to bounce back. And it’s had a couple of days that qualify for an episodic pivot over the past couple of weeks.

First, they released full-year 2023 numbers on February 21. And while earnings were pretty terrible for 2023, their guidance excited investors and they bought up shares the two days after earnings.

Then last week the market bought the dip created by Tandem announcing it was offering $250 million in convertible bonds coming due in 2029.

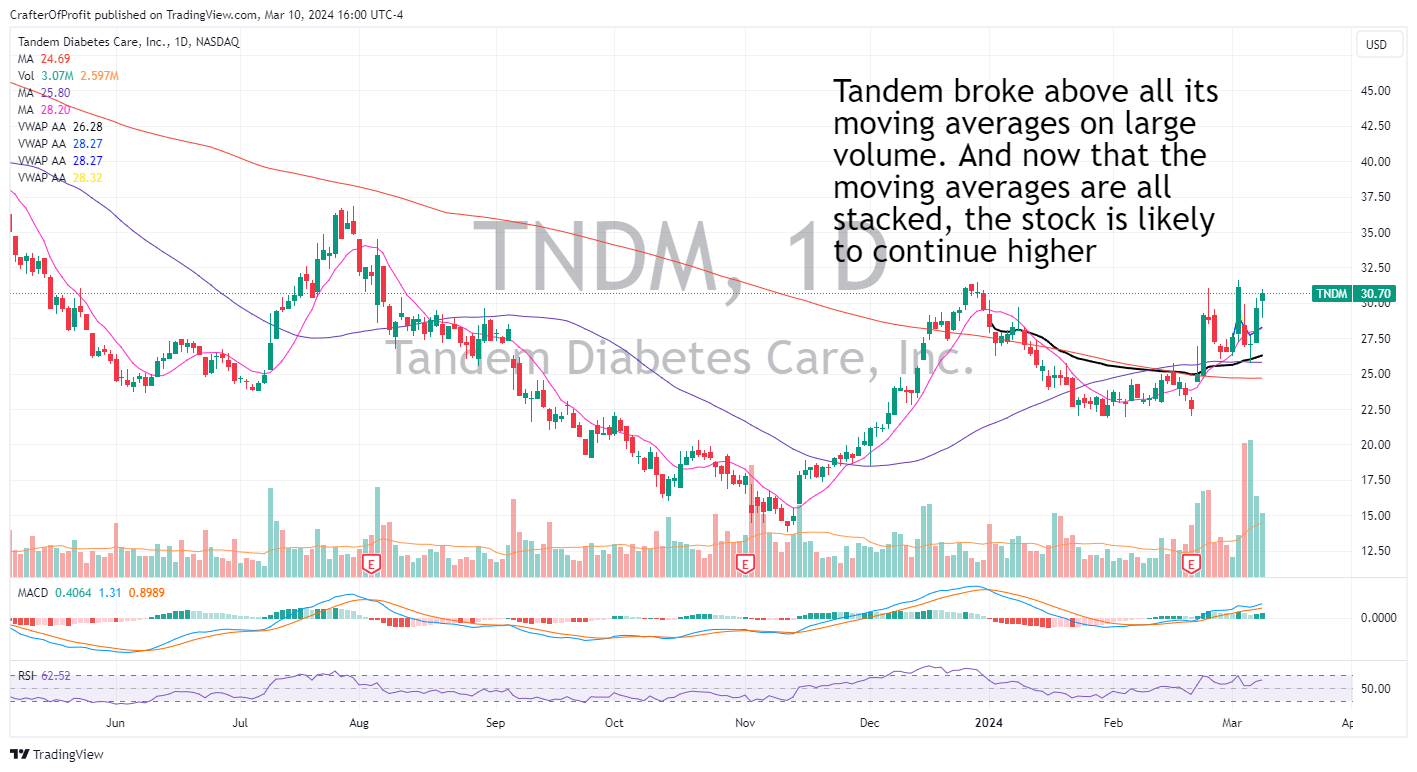

As we can see in the chart below, investors aggressively bought shares of TNDM from Wednesday through Friday of last week.

Other technicals look great too. You can see the bounce happened as the price of TNDM just touched its YTD anchored VWAP (thick black line). And now the 10-day moving average is above the 50-day and the 50-day is above the 200-day. Which is what you want to see for strong uptrends. And the price is above all three of those moving averages.

Let’s buy shares of TNDM. We’ll use the 200-day moving average as our original stop loss.

Harley-Davidson ( HOG 0.00%↑ )

I happen to think industrials look amazing right now. And if the dollar continues to weaken, that will provide a tailwind for these companies. Plus if money starts to rotate out of tech into other sectors, we’ll see a lot of money flow into this sector.

And the motorcycle company looks revved to take off.

Investors have shown an increase in interest in HOG since its earning a month ago, and then again around its dividend payment March 1.

The stock has stair-stepped higher the past month. And looks to be consolidating before its next move higher.

Let’s buy shares of HOG Monday morning. And we’ll use a tight stop of its YTD anchored VWAP which currently sits just below $36.

And that’s all for this week.

Happy Investing!