This Week in Episodic Pivots: June 19, 2023

Nothing can keep this market down.

Not even a “hawkish pause” – which is what the Fed announced on Wednesday. They left the Federal Funds rate alone at 5%, but said they would likely raise 2 more times this year.

Higher for longer. That’s the story with interest rates. A few months ago, this announcement by the Fed would have torpedoed the market at least 5% lower. But this week, the market closed up on the day.

This is why we’re holding onto our positions. Never fight the trend. And the trend is still up.

With the market up, we held onto all our positions all week.

The biggest gainer was Unity Software ( U 0.00%↑ ). This one soared the past couple of weeks on the announcement of its partnership with Apple and its Vision Pro VR headset. And now we’re up 50% on the position.

And overall, we’re up an average of 4.7% on all our positions. And we have an average holding time of just over a month now. If we can keep up this pace, we’ll finish the year up 50%. If we can maintain this through thick and thin, we’ll become very wealthy trading these explosive setups.

I’m a little nervous adding new positions right now. We are nearly fully invested. But we must trust the process. So let’s get to the new positions.

Enovix ( ENVX 0.00%↑ )

Enovix’s main products are advanced silicon-anode lithium-ion batteries. Enovix believes its batteries have a higher energy density than others on the market. This allows it to charge almost double per Wh in some cases.

Their batteries go into internet of things (IoT) devices, mobile devices, laptop computers and tablets, and they anticipate having a deal with an automotive manufacturer to supply batteries for electric vehicles within the next year or two.

This is an interesting company to say the least. And one thing we will need more of in the future is batteries.

Enovix was up last week as they announced they would surpass their production targets in the second quarter. And would produce 180,000 cells for customers from their first fab this year. They are ahead of schedule.

I expect this company will continue to go higher on the back of this news. And on the back of reports of a shortage of batteries for all our electronics.

In the chart below, we can see the stock opened higher than its trading range, dipped down to support and closed above its trading range. It tested support and passed. This stock looks primed for another move higher.

Purchase ENVX and we’ll use the 50-day MA as our stop.

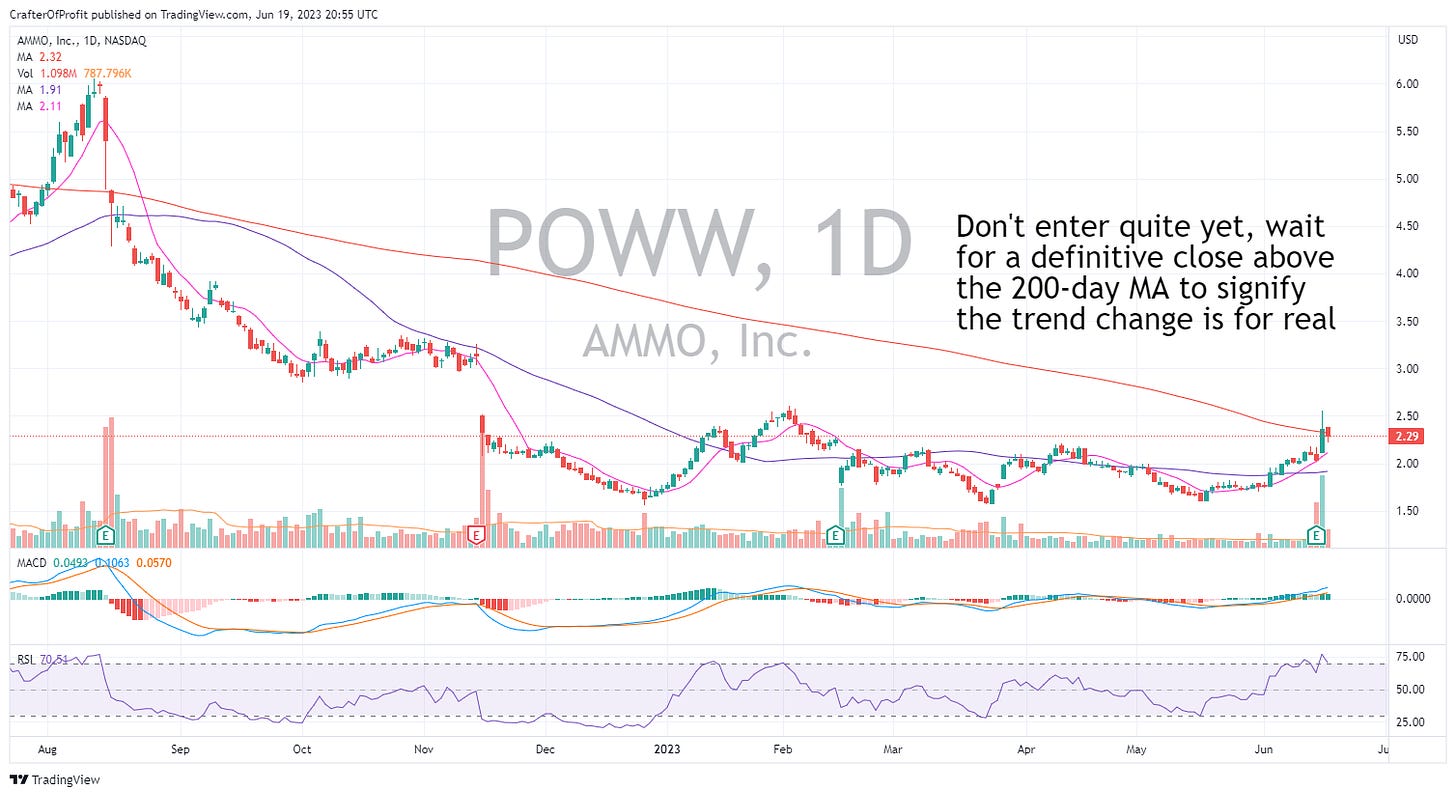

Ammo Inc ( POWW 0.00%↑ )

Ammo Inc is a vertically integrated producer of high-performance ammunition and components. That means they produce and sell their products.

The stock rose last week as the company reported better than expected earnings and online marketplace growth. They also extended their $30 million share buyback plan to February 2024. That’s significant for a company with a market cap of $270 million.

This is a small company that’s making moves. But we’re going to do something a little different with this company. We’re going to wait to enter a position until it proves to us that the trend reversal is in place.

That will be proven when the price definitely closes above the 200-day MA. POWW is struggling to hold onto its gains right now. I don’t want us to buy in too early.

So if it looks like it will close above the 200-day anytime this week, buy into the position. Otherwise, let it fall back to $1.90. That would make a low-risk entry point for us.

And that’s all for this week.

Happy Investing!