This Week in Episodic Pivots: July 30, 2023

Let the Good Times Roll

The S&P 500 just made another new 52-week high this week. Nothing can stop it. And because of that we’re going to put a couple more positions on this week.

We closed three positions the past couple weeks. All for gains. And I’m OK with that decision. Those three stocks haven’t gone anywhere since and we slightly derisked our portfolio. Even though the market didn’t turn like we feared, we are no worse off.

Picking a top is hard to impossible. In fact, I don’t like to be the guy who tries to call tops. If you’re calling for a top, you’ll end up getting out early. Then you miss the chance to let your winners run. That’s what we’ve been doing. And we’ve racked up some impressive gains. Let me list a few:

· IONQ ( IONQ 0.00%↑ ) – up 197%

· Unity Software ( U 0.00%↑ ) – up 60%

· American Axle & Manufacturing ( AXL 0.00%↑ ) – up 27%

And we’ve got several others up over 20%. It’s been an incredible run. And so far the track record of episodic pivots has done well. We’re up an average of 9.3% with a 41 day holding period. That annualizes out to a 82% gain. I hope we can keep that going.

This week we’ve got two new companies to add to the portfolio. Let’s get into them.

HighPeak Energy ( HPK 0.00%↑ )

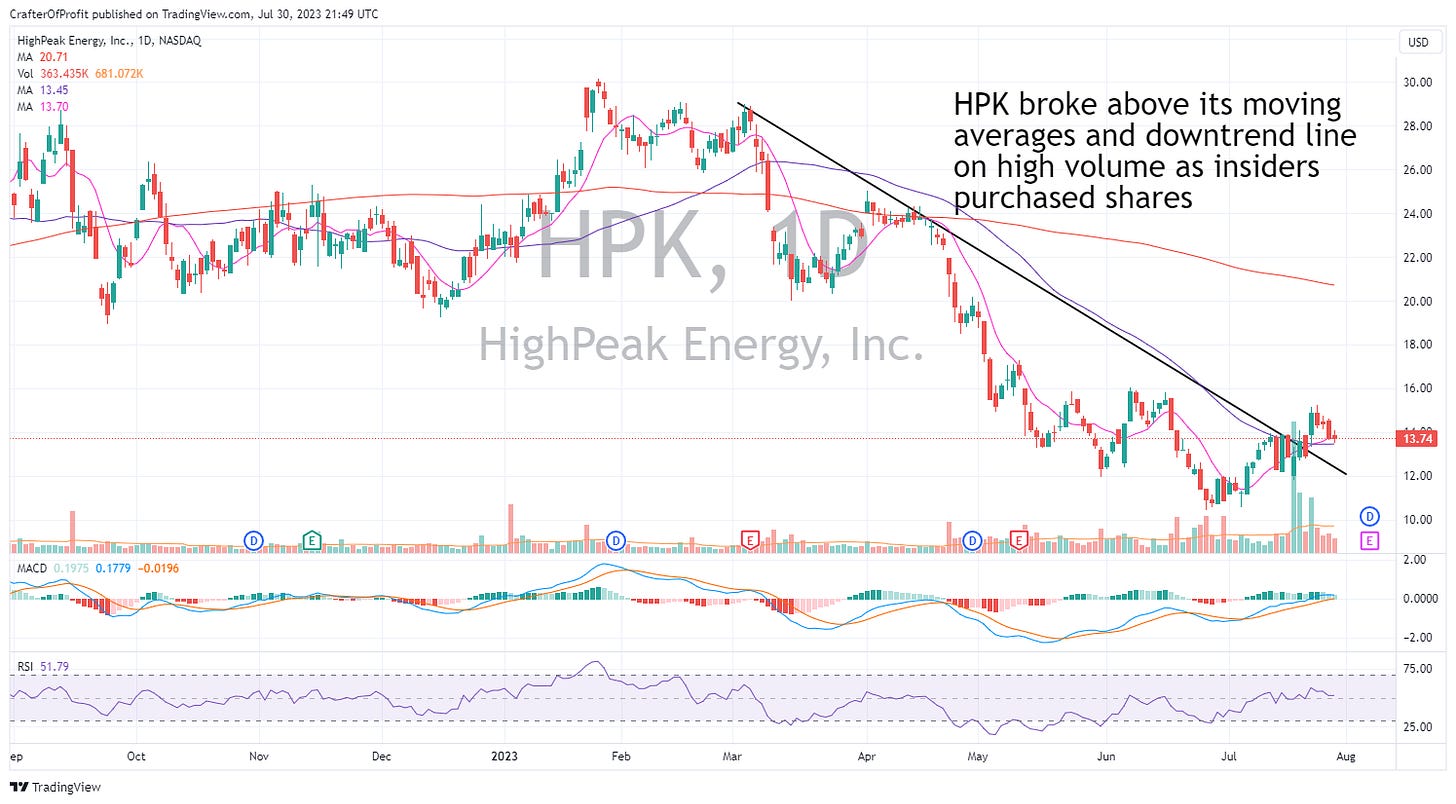

HighPeak is an oil exploration company that helps the drillers find good spots to drill. And like most oil companies this year, their stock is struggling. It’s down over 50% since peaking in February. But that looks to turn.

HPK soared last week on high volume as reports of large insider buying hit the wires. Insiders purchased of $92 million worth of shares. Which is about 6% of the outstanding shares.

That’s a large purchase. And it gives me confidence that its earnings on August 8 will come in hot. I’m actually surprised to see this buying so close to earnings, I thought executives would be restricted. But it might be because they just completed a secondary offering of shares. And now that the secondary is out of the way and digested by the market, it removes another layer of certainty.

This is a great time to buy the stock on extreme weakness. And we can get in at a price similar to these insiders. So let’s pick up shares on Monday. We’ll use $12 as a hard stop to begin with.

GDS Holdings ( GDS 0.00%↑ )

GDS is a Chinese developer and operator of data centers. They host many of the largest internet companies in China including Tencent, Alibaba, JD.com, and Baidu. Amazon is also a client. That’s an impressive roster clients. And a group that will likely continue to pay GDS into the future.

This time there’s no real news catalyst specific to GDS that pushed the stock higher. But it does have two things going for it.

First it’s a data center. And it’s a time when companies are using more compute power than ever as generative AI takes the world by storm. This trend will undoubtedly help GDS profit in the coming years.

Second, all Chinese stocks got a boost on Friday. And many traded on high volume too. Investors are taking an interest in the Middle Kingdom. And when we see that kind of interest hit a beaten down sector, we want to establish a position.

GDS is stil trading near its lows of the year. So I believe it has a lot of potential upside and investor interest returns to the company.

Let’s buy shares on Monday and we’ll use the 50-day MA as our stop.

And that’s all for this week.

Happy Investing!