This Week in Episodic Pivots: July 2, 2023

Our holdings are surging...

Wow. Last week was a lot of fun. I think we made decent money every day in our positions.

The most notable move happened in IonQ ( IONQ 0.00%↑ ) which took off on another leg higher on the week. It rose 44% on the week. The big news was that the company signed an agreement with South Korea’s ministry of Science to promote quantum computing over there.

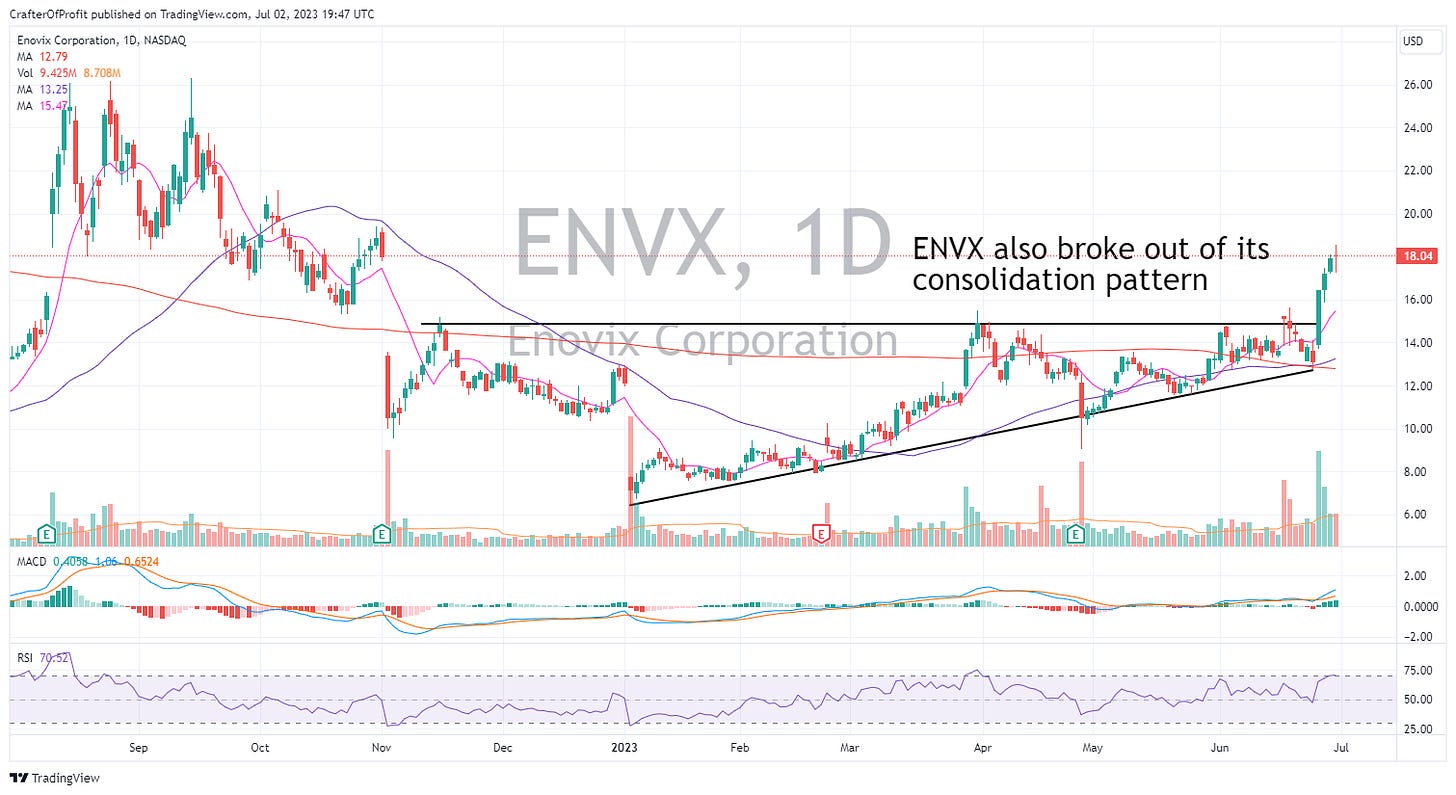

And Enovix ( ENVX 0.00%↑ ) rose 31% as it announced a contract with the U.S. Army for their conformal wearable battery packs. Big vote of confidence for the technology with the Army getting involved.

I believe we can continue to ride these positions higher in the coming weeks.

But one thing does concern me. It feels too easy to make money right now. And whenever I start to feel euphoric like this, the market often turns.

Now could be a good time for that to happen. The Nasdaq 100 just had its best first half of the year ever. EVER. That’s a strong move. And any major investment fund needed to appear fully invested at the end of the half. They would lose investors if they showed a large cash position on the books. So we could see a pullback in the coming weeks.

Typically, we don’t see any large moves in a holiday week like we have now. But either way, we’re going to take this time to get rid of a couple of our slower moving holdings. We gave these guys time to work, but they are staying stubbornly low.

Let’s sell the following names:

Lavoro ( LVRO 0.00%↑ )

Abcellera ( ABCL 0.00%↑ )

These positions aren’t acting as well as the rest. Every other stock is above major support and moving average lines. These are laggards. And this is not the market to be holding laggards.

It’s hard to find good new positions though. The market looks overextended. And so do many stocks. So let’s just ride our current holdings higher for now.

The plan is working perfectly for now. Our average position, open and closed, is up 5.9% and the average holding period is 36 days… So the annualized return is around 60% right now.

I’m trying to determine how much of this is due to the market surging higher and how much is due to power of episodic pivots. We’ll see as the market eventually slows down. Probably sometime in the next couple months….

And that’s all for this week.

Happy Investing!