This Week in Episodic Pivots: Jan 29, 2023

The first full week of earnings is behind us. And it was a barnburner of a week.

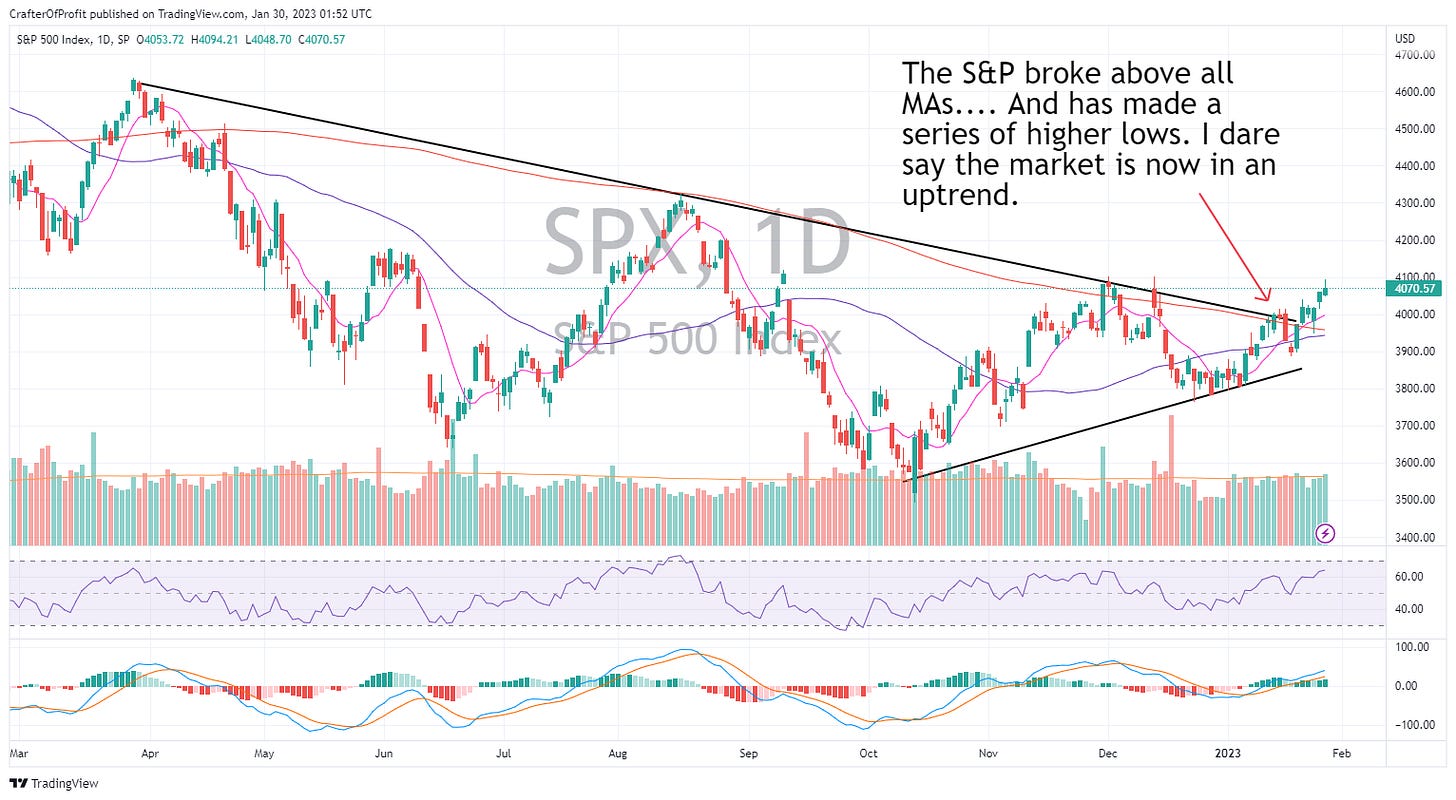

Last week we said the market was a coiled spring ready to explode… This week it exploded higher. We’re now higher than all the moving average lines on the S&P 500. And we now must have a tendency towards being long.

One thing a trader should never do is fight the trend. The intermediate trend for the market is now up.

The only thing left we need to see to verify this uptrend is a break above 4,100. That will put in a higher high than the previous peak in early December.

But I feel comfortable letting our long positions run further now. So hold on for big gains.

And we saw some big gains last week.

Portfolio Update

Both our new positions from last week had great weeks. And at one point on Friday, SoundHound ( SOUN 0.00%↑ ) was up 50%. It pulled back a little, but we are still up 27% on the week.

Energy Vault Holdings ( NRGV 0.00%↑ ) wasn’t far behind ending up 18% on the week.

We also got stopped out in on Casa Systems (CASA) position for essentially breakeven.

The rest we’re hanging onto into the coming week.

So we have 8 open positions currently. But it’s a well-diversified portfolio. And we will add a bit of diversity in this week’s picks.

This week we saw two sectors really take off: electric vehicles (EVs) and artificial intelligence (AI). Our first company is a leader in both of these fields…

Tesla ( TSLA 0.00%↑ )

Tesla needs no introduction. But the company has taken a beating over the past year… And it got worse after Elon went and started making noise at Twitter. But it appears investor interest is returning to Tesla this week.

Now typically I’d steer clear of a big company. They don’t tend to drift higher as much as smaller companies after these episodic pivots. But we have to make an exception with Tesla.

Tesla trends with the best of them. When the Tesla fanatics get behind the stock, it tends to move further than we think.

We’ll bet on this happening again. Last week, Tesla reported earnings which were much better than expected. This is a common catalyst for an episodic pivot.

The result is the company broke out of its recent downtrend and above the 50-day MA. For this position, let’s use the 50-day MA as our stop.

Applied Digital Corp ( APLD 0.00%↑ )

APLD designs and operates datacenters around the world. The company started by specializing in datacenters to support blockchain companies. But the company has recently expanded into high-performance computing and artificial intelligence applications.

The stock surged 22% higher on Friday. I’d like to wait to see if it pulls back at all Monday morning, but I’m publishing on Sunday nights… So I don’t have that luxury.

So we’ll enter this position in the morning and hope for a major continuation.

Last week APLD saw some insider buying, with CEO and Chairman Wes Cummins plunking down over $100k to buy more shares. This came after the company reported narrower than expected quarterly loss.

And if we look at the financial projections of this company over the next two years this company is cheap. They project they’ll have over $300 million in sales and be EBITDA positive by May 31, 2024. If that happens, the company is trading 1x 2024 sales and about 5x 2024 EBITDA. Even coming partially close to these numbers makes the company cheap.

Like many of our charts APLD surged higher on big volume. We’ll hold this one with a stop on the 50-day MA.

And that’s all for this week.

For any questions during the week please tag me in a post on Twitter Barbell Alpha