This Week in Episodic Pivots: Jan 16, 2023

These setups move higher in bull and bear markets... Here's the proof.

The volatility continued last week. But not the kind of volatility we’re used to seeing from the past year…. That was volatility to the downside. This was what us nerds refer to as upside volatility.

Here are Barbell Alpha, we seek out these opportunities that can surprise us by moving higher than expected. It’s why we look at plays like these episodic pivots. These are on of the strongest signals in the market for explosive moves higher.

Speaking of explosive moves, a quick mea culpa for the Virgin Orbital (VORB) pick last week. Their launched satellite blew up during the launch… And that was not good for the stock. We probably got in near $1.91 the next morning and closed out the following day at $1.62 for a 15% loss.

But the other recs did considerably better last week. Here’s a quick rundown of open positions.

· Weibo ( WB 0.00%↑ ) +25%

· Johnson Outdoors ( JOUT 0.00%↑ ) +2.1%

· Didi Global ( $DIDIY ) +39%

· Casa Systems ( CASA 0.00%↑ ) -0.6%

· Paysafe ( PSFE 0.00%↑ ) +4.0%

· World Wrestling Entertainment ( WWE 0.00%↑ ) +2.1%

These are some really good numbers. Of all the open and closed positions since we started tracking a bit over a month ago, we are up 3.7%. If we could do that every month, we’d end up very wealthy.

Congratulations to anyone who took the plunge and made these investments.

Even more impressively, we’ve made these returns while the S&P 500 plummeted in December… It has since recovered, but the S&P 500 is essentially flat since we started.

I love this outperformance.

Market Update

We’ve made these gain in the face of uncertainty… And the market is facing another test of that downtrend line we used to call the downturn in December.

Here’s a chart.

I will admit, I’m a little conflicted about this one. Traditional trend following says to follow the trend until the end. And as we are still below this downtrend line, we should respect it.

But…. The market action this past week or so has felt very bullish. It just feels different than the previous rallies up to the trendline.

One of the most notable differences in the price action is that before a retest of the trendline, the S&P made a lower low. But that did not happen this time. The market bottomed out before it was expected to. And this signifies strength returning to the market.

And if the market breaks above this line, I think we set off an intermediate-term rally in the markets. If that happens, it will be a quick move higher… And the catalyst for that move higher is likely to be earnings season.

Earnings Season Starts This Week

Earnings season kicks off in full this week. We will see some consumer companies like Netflix, Costco, and Proctor & Gamble give us a look into the health of the consumer. Are people continuing to spend? Or are they pulling back? These reports will be telling.

Many banks report this week too. And that will give us a look into the health of the credit markets – for both businesses and consumers.

We saw massive credit growth in the 3rd quarter of 2022. I look forward to seeing 4th quarter numbers as well…. But we want to watch this closely.

Credit growth is an important driver to economic growth. These are often closely connected. More credit means more money is entering the system. That’s good for the economy.

I believe this surge in credit will boost earnings for companies as they report earnings now in January and again in April.

And that is where the trap could get sprung…. Let me explain.

The Path of Maximum Pain

One could create a profitable trading strategy by figuring out what would cause the most pain to the most investors.

That right now is a swift move higher to suck everyone in…. And then a crash this summer.

Investors have rarely been so pessimistic. Just look at this long-term chart of the University of Michigan Consumer Sentiment chart.

Just a couple months ago, MORE people were pessimistic than in the depths of the pandemic and the Great Recession in 2008.

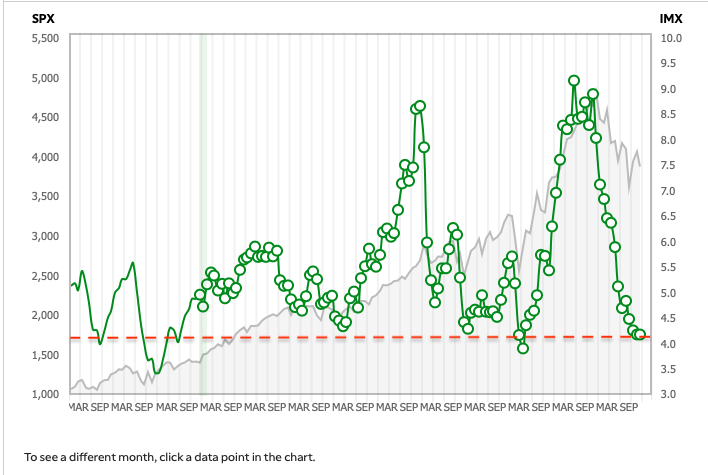

And then TDAmeritrade releases their investor movement index. It shows retail investors selling stocks off like a new pandemic is coming.

That’s unbelievable. This kind of pessimism is reserved for lows.

So this rally causes pain… Many investors are sitting this out and missing the gains.

Now I ask you, what could possibly cause more pain than missing a rally?

It’s buying in at the end of the rally and then riding stocks lower through the next bear market.

That’s my prediction for how this will play out. But this is purely a sentiment driven theory of what will happen. So keep this thought in your back pocket. Ride these waves higher, but if we see the market turn, get out fast.

New Positions

So we’re not going to wait to see what happens. We’re going to keep to our investing plans to buy strong stocks when they break out on episodic pivots.

Admittedly, this strategy got hard this past week. A lot of the breakouts continued to gain steam as the week went on. And while many stocks that finished higher every day last week still look strong, they no longer have nice, tight defined stops on the position.

And there were few events that caused sustainable moves higher. Most of the movement was due to market sentiment.

But with earnings season coming, we should see more episodic pivots in the coming weeks. Earnings releases are the most common of events to cause a pivot. So we will have many new positions in the coming weeks.

So this week will be light on new positions. But we do have a lot of positions to keep track of already… So it’s not like we’re sitting in cash.

So let’s look at the only new company this week.

Riley Exploration Permian ( $REPX )

REPX 0.00%↑ looks like it’s a family-owned business that explores, develops, and produces oil, natural gas, and natural gas liquids in the Permian basin.

The company didn’t have any major new releases last week, but this $700 million oil E&P company surged on large volume Friday.

And it broke out to new 52-week highs on that volume spike. This tells us something is going on… And there’s likely a big event coming to justify this move.

So we will enter this position and use the previous 52-week high closing price of $34 as our initial stop. This is an extremely tight stop but justified after a move like this.

We’ll likely switch to the 10-day MA as that catches up, but we don’t want to wait in case this reverses…. But with the strong economy and the dollar weakening last week, that’s unlikely to happen.

Now remember, if you’re feeling ambitious during the week you can enter these positions on your own. Just look for stocks that are up over 8% on high volume… And if you buy intraday make sure you buy as the stock makes new highs above the open the price. Don’t try to buy a falling knife…

Continue to hang onto the other positions and watch the markets. That’s all for this week.

Good luck.

For any questions during the week please tag me in a post on Twitter Barbell Alpha