This Week in Episodic Pivots: Feb 19, 2023

Our patience has been rewarded... Setups are aplenty this week

What a difference a week makes in potential setups. Last week I looked at hundreds of charts and didn’t find a single episodic pivot move that I liked. This week our patience will be rewarded. I saw about 20 episodic pivots with perfect looking charts. We’ll get to a couple of those in a minute.

It was also worth waiting as the S&P 500 was down about half a percent on the week. But the trading action was very choppy.

The bulls and the bears played tug of war with the markets. With multiple large swings in most of the daily sessions this week. I would normally say this kind of whipsaw price action is bearish… But each time the market got knocked down, the bulls rallied and pushed it back higher.

I still think our price target of 4,000 from last week stands… But with Friday’s afternoon rally, the markets are still in a bull pennant formation.

I see similar patterns taking hold in the Nasdaq Composite and Russell 2000 indices as well. So we remain in a bull market.

And even with the choppiness of last week, I think all of our holdings were up. That’s impressive. And exactly why we look for stocks showing strong price action off of a major event. They tend to keep moving higher, even if the market is flat.

We saw that happen in December when we had some big winners as the market plummeted. And we’re seeing at again.

Some people I talk to are skeptical about this rally because it’s junky stocks that are leading it higher. I don’t see a problem with that. Typically we see garbage stocks shoot higher out of a bear market because those are the ones that were feared to go bankrupt and now get another shot at life.

But those people just want the market to break. We can look at other leading sectors and see them trending higher as well. Semiconductors and financials, typically the sectors that lead the market, are having a great four months.

We likely have further to go higher… And if we do, we will likely see those companies that have been beaten down the most rally the hardest. We might even buy a one or two of them this week.

With that, let’s get on to the picks.

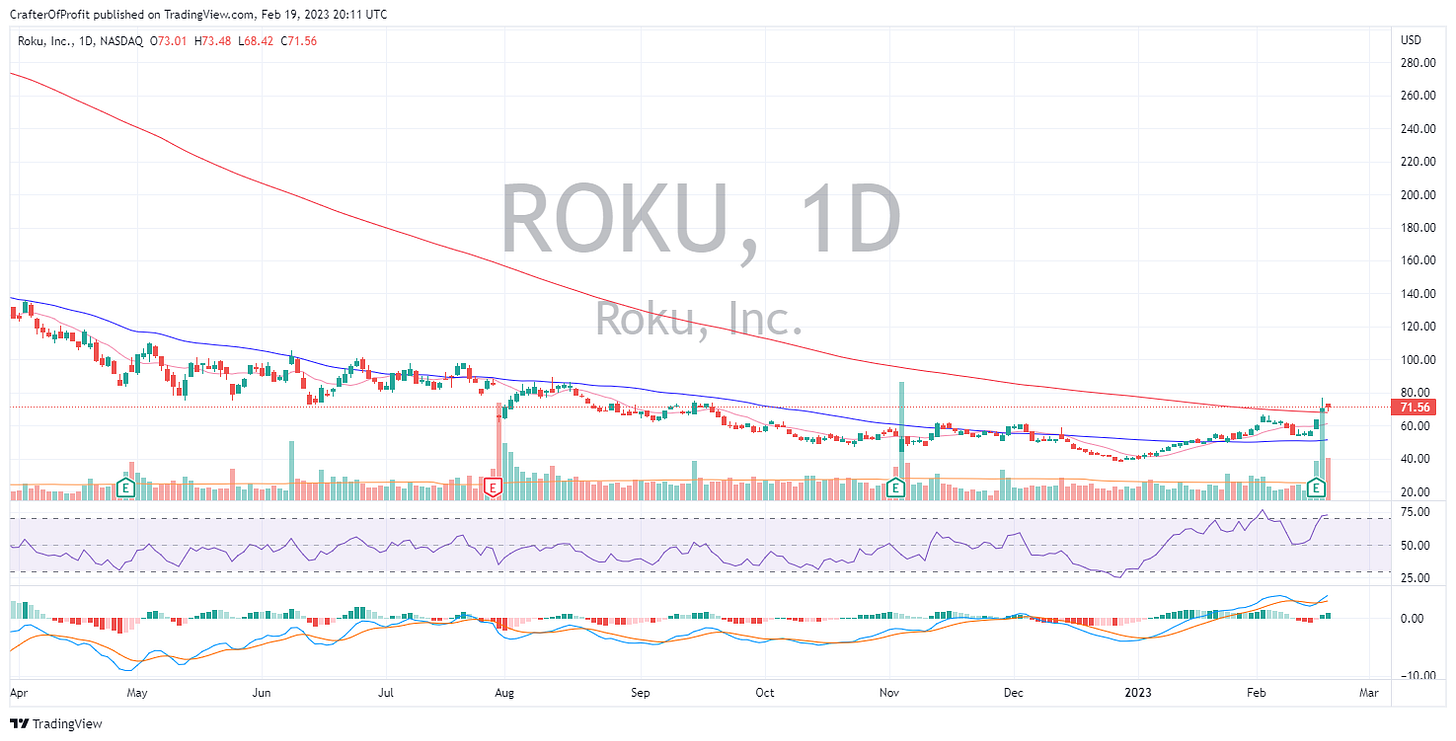

Roku ( ROKU 0.00%↑ )

The company that makes the leading television operation system has gotten crushed with many other growth names over the past 18 months. The problem is Roku’s fortunes are tied in with advertisers. And as advertising pulled back last year, so did Roku’s stock price.

But it looks like the worst might be over. The company reported earnings last week and Wall Street rejoiced.

Fourth quarter revenue smashed estimates. It came in at $867 million, which is about 8% higher than the consensus Wall Street estimates. That’s a huge beat by a company the size of Roku.

And that led analysts to believe that ad-spending has bottomed out this cycle. And one dude from Bank of America even get Roku a double upgrade. He said Roku was a sell, but now it’s a buy as ad spending from restaurants, travel, CPG, and health and wellness appear to have bottomed.

And this pushed shares above the 200-day MA on high volume last week. And I think it will use that as support and push higher in the coming weeks. Analysts and investors alike need to readjust their expectations for Roku based on its latest earnings report.

Let’s use the 10-day MA as our stop loss for this position.

And on a related trade, we should look at…

Paramount Global ( PARA 0.00%↑ )

Para owns CBS and the Paramount streaming network among other things. And the future of the company relies on this streaming service to thrive…. And for advertisers to shell out for ads.

Much like Roku, Paramount leaped over its 200-day MA on high volume after its earnings report last week.

Paramount saw its streaming service gain 9.9 million subscribers (the author of this piece being one of them) to its Paramount+ streaming channel. This helped lead to a huge beat on ad revenues.

At first Wall Street didn’t like this, but common sense prevailed and pushed the stock higher. On large volume. The below chart shows PARA shares breaking above its previous resistance point of the 200-day MA.

We’ll use a stop of $21 until the 50-day MA works its way above that level. Then we’ll switch to that.

QuantumScape ( QS 0.00%↑ )

Much like the first two, QS showed great volume on a breakout after its earnings report. I’m encouraged by the price action here… And if people start to get excited about this one, the stock could rocket many multiples higher. This stock is a great momentum play.

QuantumScape’s earnings were… umm… not the greatest. Their loss widened. And as they are pre-revenue, this means their cash burn as increased.

But management said on their call that they are making progress with the solid-state battery technology. And “that generally, most cells have performed well on initial testing, including fast charge and early-cycle capacity retention.” That’s a bit of techno-babble, but Wall Street is hopeful they will continue making progress on bringing their batteries to market.

Despite this mostly poor performance, the stock is higher on large volume. That could be a sign of a bottom. Usually when a stock rallies on bad news, it means higher prices are in the future… And as we said, if this catches a bid, it’s going a lot higher.

And over the two days after earnings, prices retested the breakout level and held. That’s a sign this could be sustainable.

Let’s use $8.75 as our stop and when the 50-day MA goes above that level, we’ll revert to that.

We now have 11 open positions. It’s a lot, but it’s manageable. I think before we add anymore, we’ll close out of a long term holding. For instance, we’re dutifully holding onto Johnson Outdoors ( JOUT 0.00%↑ ) but that guy doesn’t seem to want to move anywhere. We’ll give it a bit more time… At least until we find a more promising looking chart setup.

And that’s all for this week. Remember, the market is closed Monday for President’s Day. Take it easy and relax a bit, will ya?

For any questions during the week please tag me in a post on Twitter @BarbellAlpha