This Week in Episodic Pivots: December 17, 2023

We have a new trade this week!

What a wild ride in the markets. It’s been pretty much a straight ride higher the past two months. I hope we all made a lot of money in the runup.

These kind of runs are a lot of fun. But be careful. They don’t last forever. And we should expect a pullback of some sort eventually…

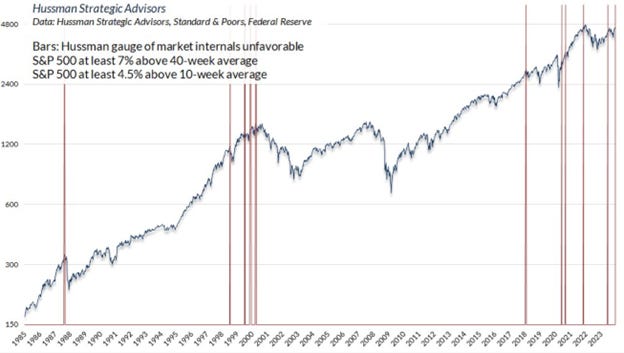

This runup is getting a bit ahead of itself. The chart below marks the previous times that the S&P 500 got far above its moving averages. The results typically mark the end of the run.

For now though, just rise your stops and keep riding this wave higher. Not all of these marks bring sustained downtrends.

We took some profits off the table before the Fed meeting announcement on Wednesday. I still believe that was the right call despite those stocks going higher. De-risking going into the announcement was the prudent play.

It appears no one thought Powell would tell us the Fed Funds Rate Committee was practically done raising rates. And they’d consider lowering them before inflation reached their 2% target. They said that 3 rate cuts next year is their base case.

That’s a newly dovish stance from the Fed. Now I somewhat expect the Fed governors to walk back this announcement a bit in the coming weeks when they do interviews. But I’m not sure the market is going to care at that point.

It’s risk on.

And this runup has all investors going limit long. Below is a chart of the net speculative positioning of asset managers and leveraged funds. These funds have never been so long in their history.

This trend can continue if that line keeps going higher. But eventually, the hype will die down. That will create a challenging environment for prices to rise.

Like we’ve talked about, there are cracks forming in the economy and the markets. And eventually, something will break. But we don’t know when. So we’re going to add another position this week.

American Lithium Corp ($AMLI)

AMLI is a lithium (and uranium) exploration company. They don’t produce any lithium yet though… And are unlikely to do so for a couple years.

But they have the rights to two of the largest lithium deposits in the Americas. One in Nevada and another in Peru.

On Friday the company released an updated technical report on the Falchani Lithium Project in Peru. That report said the Falchani project had 476% more measured and indicated resources (lithium) than previously estimated.

That’s great news. Either AMLI will make a lot more money on this mine when it becomes operational or they will look more attractive to a larger company like Albemarle ($ALB). Either way, the valuation of these shares should go higher.

This sent shares 10% higher on massive volume on Friday. This recent surge of volume on up days is a good indicator of a trend reversal.

We want to ride this wave of excitement higher. So we’re going to buy shares Monday morning. We’ll use the 50-day moving average as our initial stop.

And that’s all for this week.

Happy Investing!