This Week in Episodic Pivots - December 5, 2022

Find the latest stocks setup to surge higher.

Welcome to the inaugural issue of This Week in Episodic Pivots. Here we will highlight the latest stocks making episodic pivots and if we think it’s a good entry point.

Then we’ll track these stocks as time progresses. And we’ll finetune or system to get the most out of these high potential trading setups. Eventually, I plan to include company profiles of stocks that make our screens – but that’s a long-term work in progress.

A trending term in the technical analysis community lately has been “episodic pivot.” This can be defined as a stock that surged higher (generally over 8%), on high volume with a catalyst. And ideally this surge will come out of a nice, defined base… And a flagging pattern in an uptrend.

For more details on what an episodic pivot is, refer to the original writeup on episodic pivots (EP).

This will come out at least once a week… Maybe more depending on market conditions.

But it’s important to keep the overall market trend in mind. While EP can signal a setup that will defy a market downtrend, it’s always easier to buy stocks in an up-trending market.

Right now the S&P 500 just failed a breakout above its 200-day moving average. This is a bearish sign for the remainder of the month.

Now, this doesn’t mean we shouldn’t try to get long on some positions. But it means we should have tight stops… And maybe even hedge our positions by buying some puts or selling call spreads on the markets. We’ll talk more about hedging later. If you don’t know how to properly hedge, please don’t. Learn before attempting.

Let’s get onto the highlighted companies.

UiPath (PATH)

The first company is PATH. They just reported earnings last week and the market liked what they saw. Earnings is the most common catalyst for an EP. And one that we’ll see a lot.

The day after the EP breakout, prices fell with the market. But that’s a good thing. It did 2 things: 1. It closed the earnings gap. 2. It tightened up our stop.

It’s a little hard to read, I need to figure out how to play with the axis in TradingView a bit. But we can see the breakout… And the price sits right on top of the 10-day and 50-day moving averages. Any close below $12 a share can be our exit point initially.

But our initial target higher is around $18 - $19. It depends on how quickly it rises to the 200-day MA.

Samsara (IOT)

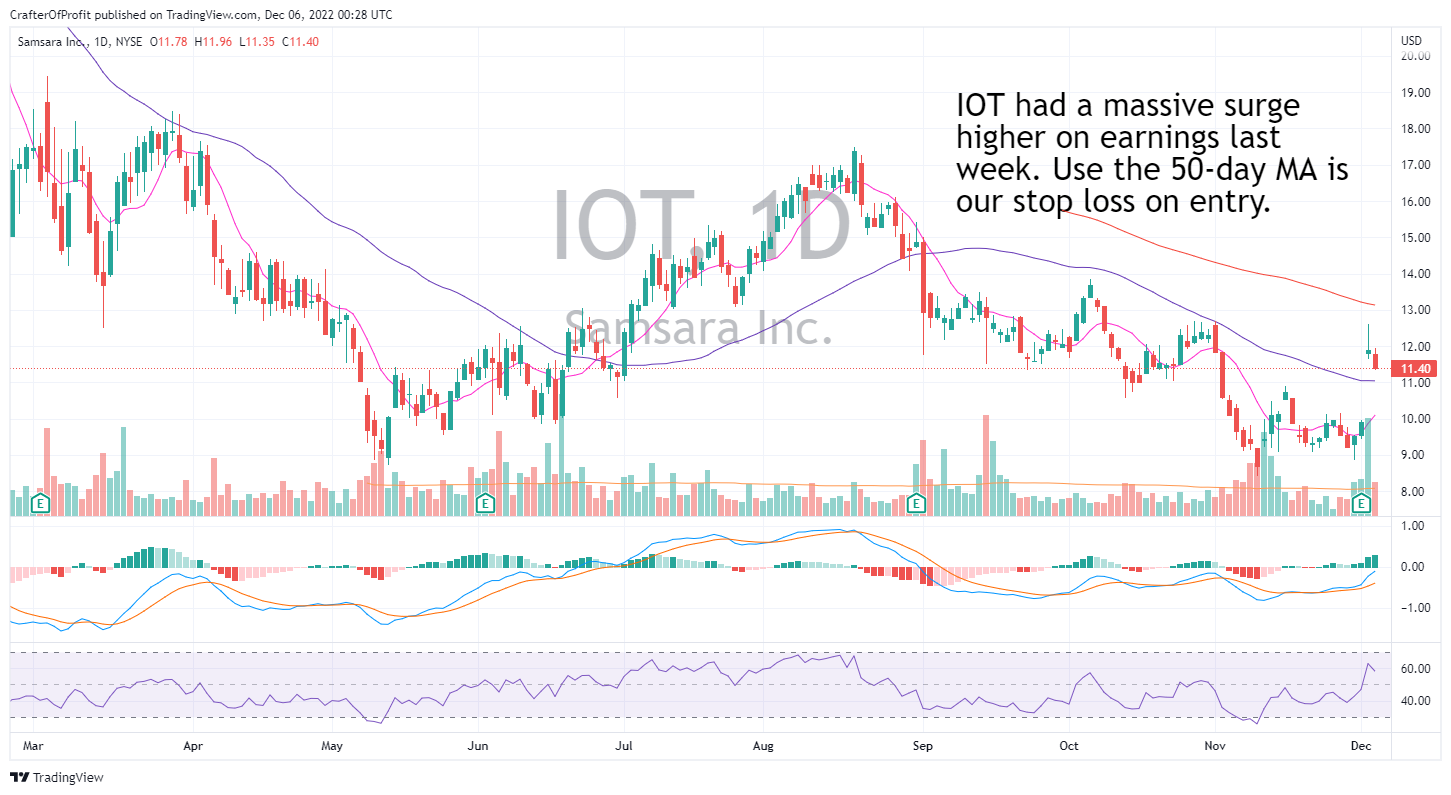

The next company is IOT. This is also an earnings-related EP. Investors loved the report and sent the stock way higher.

The stock did pull back with the market today… Which makes me worry a bit about this one. It’s not as clean looking as PATH. But we can still use the 50-day MA as our stop loss. I’ll give it a few more cents, but any close below $10.75 means the plays is broken.

But this one is worth the risk. As a relatively new company, it can attract a lot of attention if it gets some momentum behind it. So watch out.

Weibo (WB)

Weibo has gone higher with the rest of the Chinese stocks. I’ll be the first to tell you, don’t get married to these positions. I don’t know if these will be long good term investments. But these make great trading vehicles.

Over the past month Chinese stocks have caught a major bid. Some have even double. WB has been a little more reserved, but that gives it a chance to play catchup now.

WB looks like it just started its next leg higher with the recent breakout. Continue to watch this one. Use the 10-day MA as the stop loss. The first profit target will be the 200-day MA.

Once again welcome to our inaugural issue. And hope to see you around… So we can strengthen our portfolios and find some alpha together.