This Week in Episodic Pivots: August 20, 2023

Another explosive setup we can trade for potential profits

So much for the dip being over. Last week saw the S&P 500 dip another 2.1% and it took down most of our holdings with it. And we stopped out of a couple more positions.

Everyone should have sold the following:

IonQ ( IONQ 0.00%↑ ) – and we had a blended 99.8% gain on that position. Congrats to all that made that trade.

Accel Entertainment ( ACEL 0.00%↑ ) – sold for a 17.2% profit

GDS Holdings ( GDS 0.00%↑ ) – sold for a 18.6% loss

And we might be selling Arcosta ( ACA 0.00%↑ ) if it doesn’t retake the 50-day MA early Monday morning. The rest are looking strong.

We’re booking some big gains and holding a nice sized cash position as the market falls.

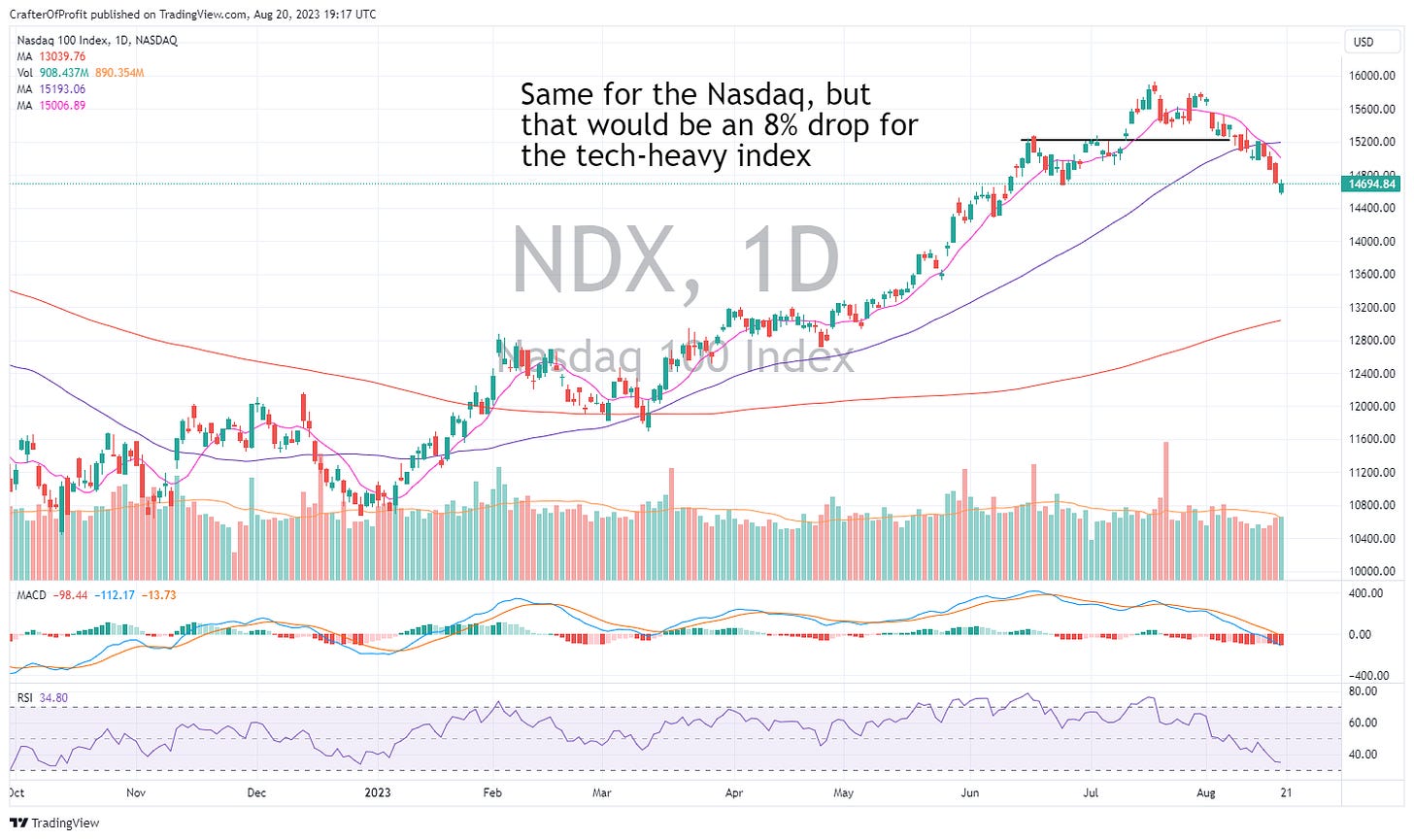

The market has fallen back to the levels we saw in June. It’s not a huge fall yet, just a standard run of the mill correction. But now that the market has pierced the 10-day and 50-day moving averages, its likely the markets fall back to the 200-day. That’s about 5% lower from here in the S&P.

And the Nasdaq looks a bit more perilous. It would take a 9% fall for that index to reach it’s 200-day MA.

Leading economic indicators are starting to turn negative. I saw a chart somewhere on Twitter earlier today, but forgot to save it. You’ll have to trust me on this one. So we have to see if the strong, lagging indicators start trending lower.

We could be at a turning point. But we will see… I expect the next couple months to be bumpy. Typically August – October are more volatile than average months. So strap in.

But we want to hold onto our positions as long as they’re above our stops. We’re holding onto some stocks that are holding up quite well. And the top performers in a downturn often catapult higher once the market bounces back. We want to be holding some of those companies when the reversal happens.

And on that note, we’re going to buy one more company this week. We’re going to take our time redeploying our cash. Going to do it disciplined.

Adecoagro ( AGRO 0.00%↑ )

Adecoagro is an Argentinian company involved in farming, cattle and dairy operations, sugar, ethanol, energy production, and land transformation.

There are two reasons I like this trade right now. Well three if you include the chart, which I’ll show in a bit. But the two fundamental reasons are that company just released great earnings last week. Sales increased 6.5% from last year and EBITDA rose 15.2% from this quarter last year. Both better than anticipated. This is also a profitable company trading at an EV/EBITDA of only 5.3x.

The second reason is the rising popularity of the conservative Presidential candidate in Argentina. Milei is gaining press and he’s a libertarian at heart. He said he’d gut the central bank and bring stability back to the Argentinian currency. Maybe, maybe not. But we can expect a country that is business friendly if he takes office.

Milei would be great for stocks. They’d all be trading at much higher valuations. Oh, and he said he wouldn’t cut off the welfare that supports nearly half the country. He’s not crazy. So that’s looking promising.

Now let’s look at the chart. AGRO is in a nice upward trend that follows an uptrend line very closely. And after breaking below that trendline, it bounced back again. A failed breakdown. I believe that makes this likely to continue rising. We could probably use that trendline as a stop, but it feels a little too close for comfort here. So we’ll start by using $9.25 as a hard stop.

And that’s all for this week.

Happy Investing!