This Week in Episodic Pivots: April 30, 2023

Get in on these explosive setups

The market is looking weak.

Despite the strength in earnings last week, the cracks are forming. Sure, the large cap FAAMG stocks are performing well. They just slayed their earnings. META and MSFT were up double digits around their earnings.

And when you include NVIDIA and its boost due to AI adoption in the mix, these large caps are pulling the index higher.

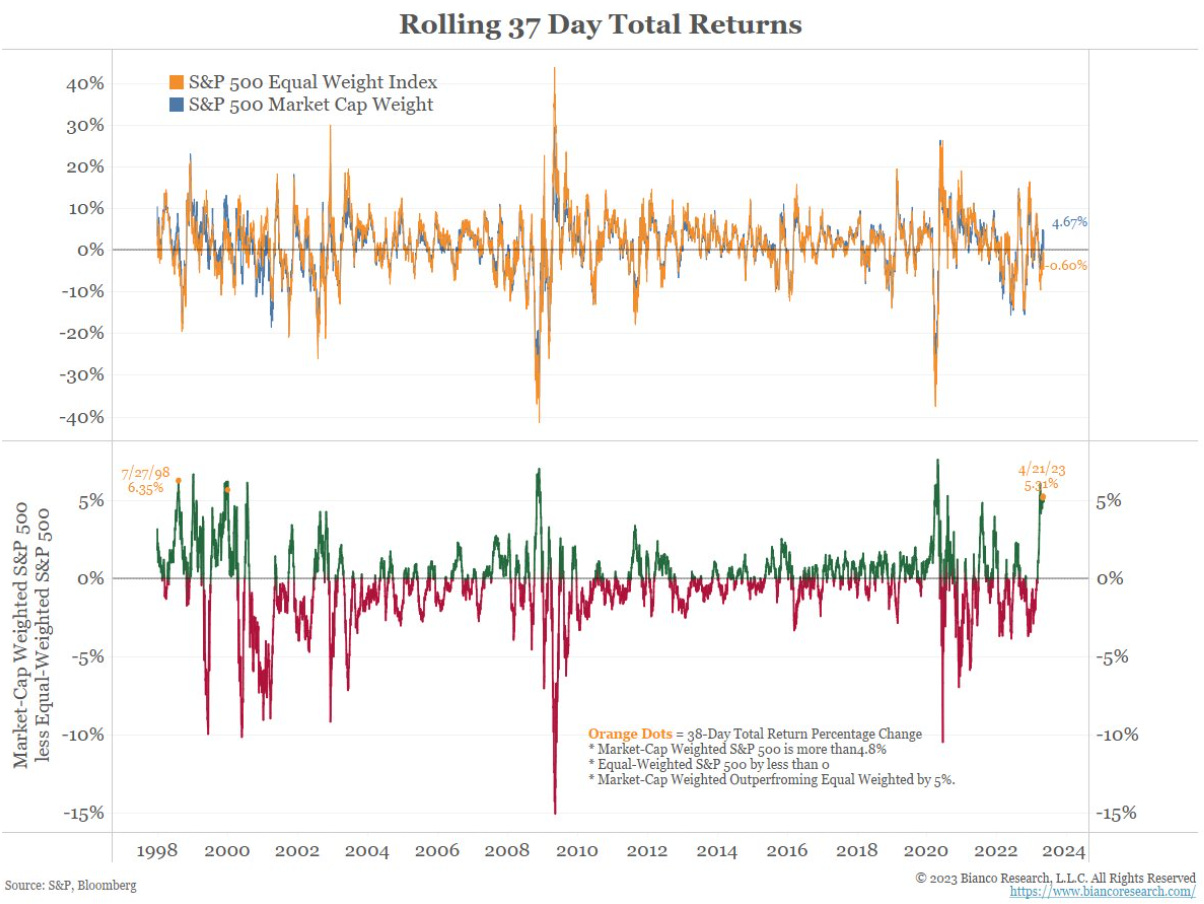

Anyway we want to measure market breadth, it’s looking extremely weak. The weakest it has been since February 2020, and before that mid-2008.

Here is a chart from Bianco Research showing the 37-day rolling returns of the S&P 500 index vs the S&P 500 equal-weighted index. The bottom half is the important one to look at. And as shown, this is the highest level of outperformance since the periods we mentioned above.

Even the strongest pillars will crack under too much pressure. And right now the markets are being held up by the megacap tech stocks. But if these start to crack, the markets will crumble.

And I’m feeling cautious with Apple’s earnings coming up. They already told us that PC shipments fell 40% year-over-year. So it will be unlikely Apple beats expectations… But who knows.

I know I’ve said this a lot, but we need to be careful. Looking back, we would have been better off investing in just large cap stocks and that’s it. But that’s not a normal market environment.

That being said, I’m looking into ways to hedge our positions. We could use put options on the indexes… Or maybe there are single stock stories to buy puts on that would give us more alpha.

I’ll let you all know soon. I have a few irons in the fire now. Just have to figure out the one that’ll work best.

Portfolio Update

Last week we got stopped out of Apollo Medical Holdings ( AMEH 0.00%↑ ) and Renew Holdings ( RNW 0.00%↑ ). So we will stop tracking those and find other places to put money to work.

The rest of our positions finished the week mixed. But we should stick with our original trading plan for the week.

I also want us to close the Franchise Group ( FRG 0.00%↑ ) position tomorrow. We are up 16.6% on the position and it’ll be a nice gain. We entered into the position because they received a $30 per share unsolicited bid for the company. And shares closed Friday at $29.25.

Sure, FRG is shopping around for higher bidders, but I’m not sure they’re going to get it. $29.25 is close enough to $30 for me. Let’s take the guaranteed W.

I’m also not sure how Western Alliance Bancorp ( WAL 0.00%↑ ) will fair on Monday with the trouble surrounding First Republic Bancorp this weekend. But we have our marching orders. Hopefully the markets will remain rational and realize WAL is safe and that’s why depositors are going there.

But contagion fears cause investors to do irrational things. And Berkshire Hathaway co-chairman, Charlie Munger said he was concerned about the situation with banks over the weekend. That’s not going to help confidence. Usually it’s him and Buffett that are the backstops for banks ala 2008. But they haven’t stepped in yet.

That said, we’re going to keep adding some positions to the portfolio.

Arcosa ( ACA 0.00%↑ )

Arcosa is the quintessential American infrastructure play. This company specializes in the construction of transportation lines, energy projects, and construction site support.

And business is good.

Last week they reported earnings. And they surpassed their sales expectations by 10%. That’s an incredible beat. And they nearly doubled their adjusted EBITDA target. They projected 55 cents of EBITDA, but logged $1.06 worth.

This strong performance shot the stock out of its 8-month trading range. And now it is set up to take its next leg hire. And, by just eyeballing the previous gain, it looks like that could be a 35% move.

We’ll use the 200-day MA as our stop on this position.

Medpace Holdings ( $MEDP)

Medpace is a contract research organization, meaning they help biotech companies get through the drug trials so they can market their drugs.

And they’ve done quite well in this endeavor. To the point they’re a $6 billion company.

They also had a great earnings report this past week. On the 24th they announced they announced a beat and raise quarter.

Despite the strong performance, the stock pulled back, albeit briefly, where it traded before earnings. But then it bounced higher after closing the earnings gap. That’s a great sign for future increase. And gives us a chance to enter the position with a tight stop.

We’ll use a hard stop of $185 to begin with this position.

And that’s all for this week.

Happy Investing!