This Week in Episodic Pivots: April 16, 2023

Two new explosive setups this week

In life there are winners and there are losers.

This week we found out who the winners are from the Silvergate and Silicon Valley Bank collapses: big banks.

Last week JPMorgan, Citi, and Wells Fargo all reported amazing numbers. Higher interest rates that brought down the loan portfolios of those failed banks aren’t impacting the big boys at all. In fact, these banks beat as the net interest income soared above expectations.

And put that on top of a quickly growing customer base and you’ll see bigger numbers for these too big to fail banks for the rest of the year.

JPMorgan alone saw deposits increase $50 billion in the first quarter.

All these recent bank failures have accomplished is to make the big banks even bigger. And put more concentrated risk in our financial system.

Now that isn’t a reason for concern yet. And could potentially never be. But I prefer my banking system to be antifragile. And the way to do that is to have a larger number of small banks. That way if a couple of them do something to lose money, it won’t bring down the entire financial system.

But what should investors do with this information? Likely buy these big banks. Business is good.

And as we see inflation come down, it’s likely we’ll see an increase in trading. And that is always good for these banks that act as custodians as well.

This next week has a lot of big earnings reports that could move the markets.

Tuesday has Bank of America, Johnson & Johnson, and Netflix. Wednesday has Tesla and semiconductor equipment manufacturer Lam Research. And then Friday morning is interesting with commodities companies Freeport-McMoRan and Schlumberger reporting as well as Proctor & Gamble. This will give us a lot of insight into consumer demand.

Its worth paying attention to these earnings releases. Often management will drop little gems about what we can expect going forward. And we can extrapolate those comments to their competitors.

Portfolio Review

Last week we rode most of our positions higher. And we didn’t get stopped out of any positions.

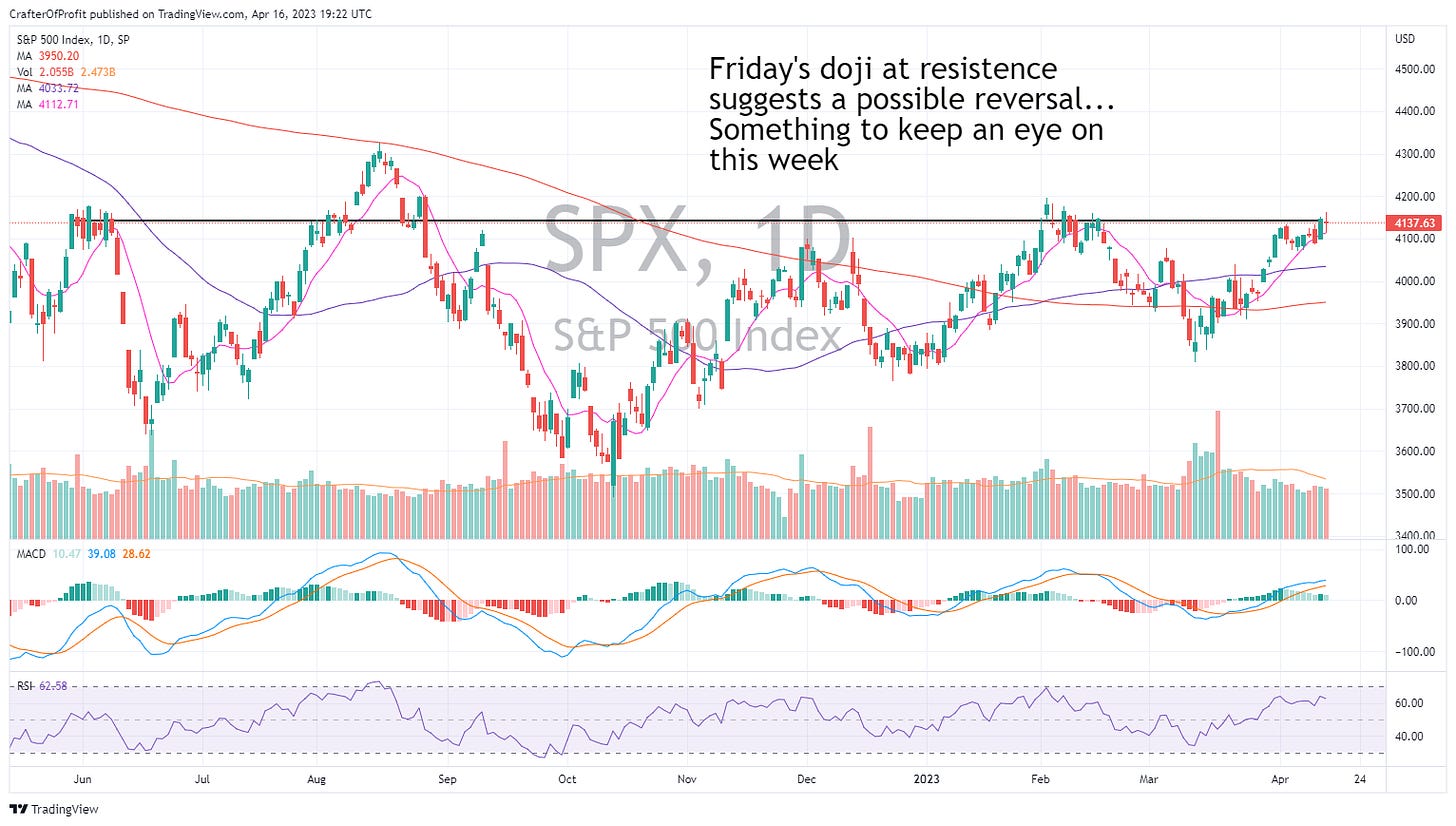

Not surprising as the market was up on the week. Thursday was a big day up for the market. Although, Friday’s market action was a bit worrying. We saw a big doji candle – a candle that looks like a spinning top – forming at the resistance line we drew for the S&P 500 last week. A doji can be an ominous sign after an uptrend as it signals indecision in the market.

I don’t see anything else of importance for our portfolio to mention right now. Just keep holding and respect our stop losses.

With that let’s get onto the recommendations…. One will be conservative and the other a bit more speculative.

Shockwave Medical ( SWAV 0.00%↑ )

SWAV’s main product helps get rid of calcium buildups in blood valves. This reduces the amount of stress on a heart trying to pump blood through hardened and shrunken blood vessels. This is a life saving technology.

And just last week the Centers for Medicare and Medicaid Services proposed a rule for three high-paying codes for “coronary intravascular lithotripsy.” That’s what SWAC treats.

Analysts expect these new codes could increase SWAV’s compensation amount by $4,000 - $5,000 over the prior codes. And it shows that the CMS likes what SWAV is doing. So the company will likely see more business come its way and it’ll be able to charge a higher price.

This news sent the stock up nearly 11% on the day. And it’s continuing to look strong.

We’ll use $235 as a hard stop to begin with for this position.

BigBear.ai Holdings ( BBAI 0.00%↑ )

BBAI develops artificial intelligence and machine learning (AI/ML) software to help companies make optimal business decisions. And it’s getting a lot of attention.

This past week the company took action to shore up its balance sheet. Analysts feared the company may be teetering towards bankruptcy and would have to sell shares at poor prices. But BBAI used the recent strength in AI companies to sell shares at good valuation.

So now the looming threat of bankruptcy is gone, investors can focus on the growth of the business. And they like what they see.

We can see that last week shares of BBAI broke above all moving average resistance on high volume. This makes it likely that we’ll see an extended rally in BBAI.

We’ll use $2.70 as a hard stop to get the position moving.

And that’s all for this week.

Happy Investing!