This Week in Episodic Pivots: April 9, 2023

3 New Explosive Setups This Week

That was kind of a boring week. The holiday shortened week really didn’t provide any surprises for us. And I could really show you the same chart of the S&P 500 with the same message as last week.

We are still trending up, but we are facing a resistance point at 4,150.

The market is trading very technically still. In my experience that tends to mean we are in either a range bound or a bear market. And we have a lot of resistance to blow through before I’m willing to say we’re in a bull market again.

So we’re going to keep our stops tight and try to take some quick profits.

That’s what we did last week. For anyone following along, you should have sold 3 positions.

The first positions was WWE. I said I’d sell that after watching some price action on Monday. And I would have sold it during the afternoon trading. So we’ll mark that as a W… Although if you held on another couple days, you could have made another 20%. Hope you all did.

Then both Tesla and Freyr Batteries broke through resistance points and our stop losses. So we’ll book a small gain in TSLA and a small loss in FREY.

The loss of FREY is disappointing as it happened so quickly. But we took a small 3.5% loss on that position. And we’re up 12.8% on IONQ which we also purchased at the same time.

The churn in the portfolio is good. It keeps us from being overly invested if the market does pull back quickly. That was a tough week in early March when stocks pulled back and we stopped out of like 10 positions.

Overall, we are averaging a 4% gain on every position. And the average holding period was just 29 days. We could probably make a case for making 50% annualized gains at that pace.

This week I have three positions that I’d like to add to the portfolio to make up for the ones we sold.

TH International ( THCH 0.00%↑ )

This is the sole franchisee of Tim Horton’s in China. And last month they signed an agreement with Popeye’s to bring delicious fried chicken to the Middle Kingdom.

But the important part is the company announced earnings last week and they showed impressive revenue growth despite there being pandemic lockdowns in China.

This shows the companies innovative abilities as they focused on delivery and pick-up. Revenue rose 34.6% year over year. And their loyalty club sign-ups increased 88.5% on the year.

That’s a great sign for future sales. And we’d expect those to pick up even more as the lockdowns have ended in China. Now the Tim Horton’s can open their doors to customers.

We have had some luck already catching momentum in Chinese names earlier with double digit gains in Weibo and Didi Global. We have the potential to do that again here.

We’ll use $3.75 as a hard stop for now. We’ll raise this as time goes on.

Butterfly Network ( BFLY 0.00%↑ )

BFLY specializes in medical imaging devices. They have a portable ultrasound device on the market now.

And the FDA just approved an add-on for that which is an AI-enabled Auto B-line Counter. This will help diagnose people who are suspected to have diminished lung capacity.

The device will launch in the U.S. this summer. This news caught the attention of the investing community. And even Ark Funds established a position in BFLY as they see good things ahead of the company.

This device should help stem the bleeding cash flows. And even makes it likely that they will get acquired by a major medical device company like GE Healthcare, Medtronic, or even MMM.

We’ll watch the technical closely as this progresses. And will likely bail on first sign of weakness. Even though they raised enough cash to last for a couple years, we don’t want to see our position tank due to dilution from a stock offering.

We’ll use $1.78 as our hard stop on the position.

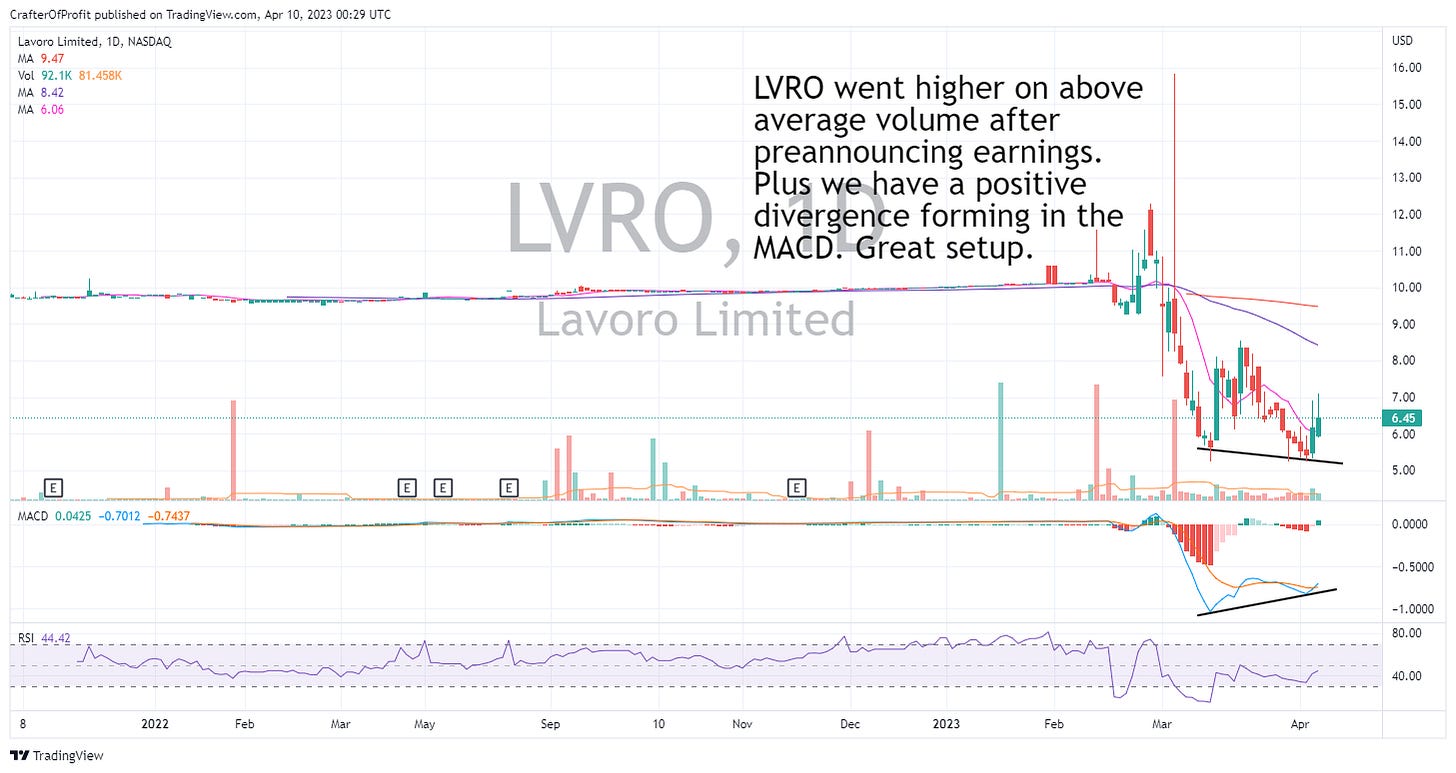

Lavoro ( LVRO 0.00%↑ )

This is a recent de-SPAC. And it just started trading as LVRO a month and a half ago. So it’s still new and the market is trying to find a price for it.

The company is a supplier of agricultural products to farmers in Latin America.

And they are growing like a weed – pun intended. Last year their adjusted EBITDA increased from $63 million to $118.5 million. And this is mostly due to its growing business, not acquisitions.

$118 million is a lot of profit for a company with a market cap of only $807 million. Put another way, it’s trading about 7x EBITDA, and growing EBITDA almost 100% a year.

With a little more research, this could be an amazing value play.

But that’s not why we’re here. We’re here to profit off of episodic pivots. And we have the episode and we have the pivot here with LVRO.

I like this chart the more I look at it. We have a positive divergence forming with with MACD and RSI as well. I’m stoked with this setup.

We’ll use a hard stop of $5.50 to start with on this position.

Until next week, happy investing!