The Markets Are Turning

It's a time to be careful again

I’m going to make this brief. I might come back and show some more detail about why the market is changing.

First, I want everyone to sell Valero (VLO). This is our newest trade, but the oil industry ran up quickly and is now reversing. Hard.

Just look at the Energy Sector ETF (XLE). This is a classic reversal. On Friday we had a bearish engulfing pattern and then the pattern was confirmed by a follow-through day lower yesterday.

We do not want to be in energy stocks anymore. I think it’s likely it goes back to the mid-80s in the coming months.

The rest of the market doesn’t look any better. Look at the S&P 500 Index. It just closed below the 50-day moving average (MA). The last time it cracked the 50-day MA after a major rally was in August last year. And the market went on to go about 10% lower.

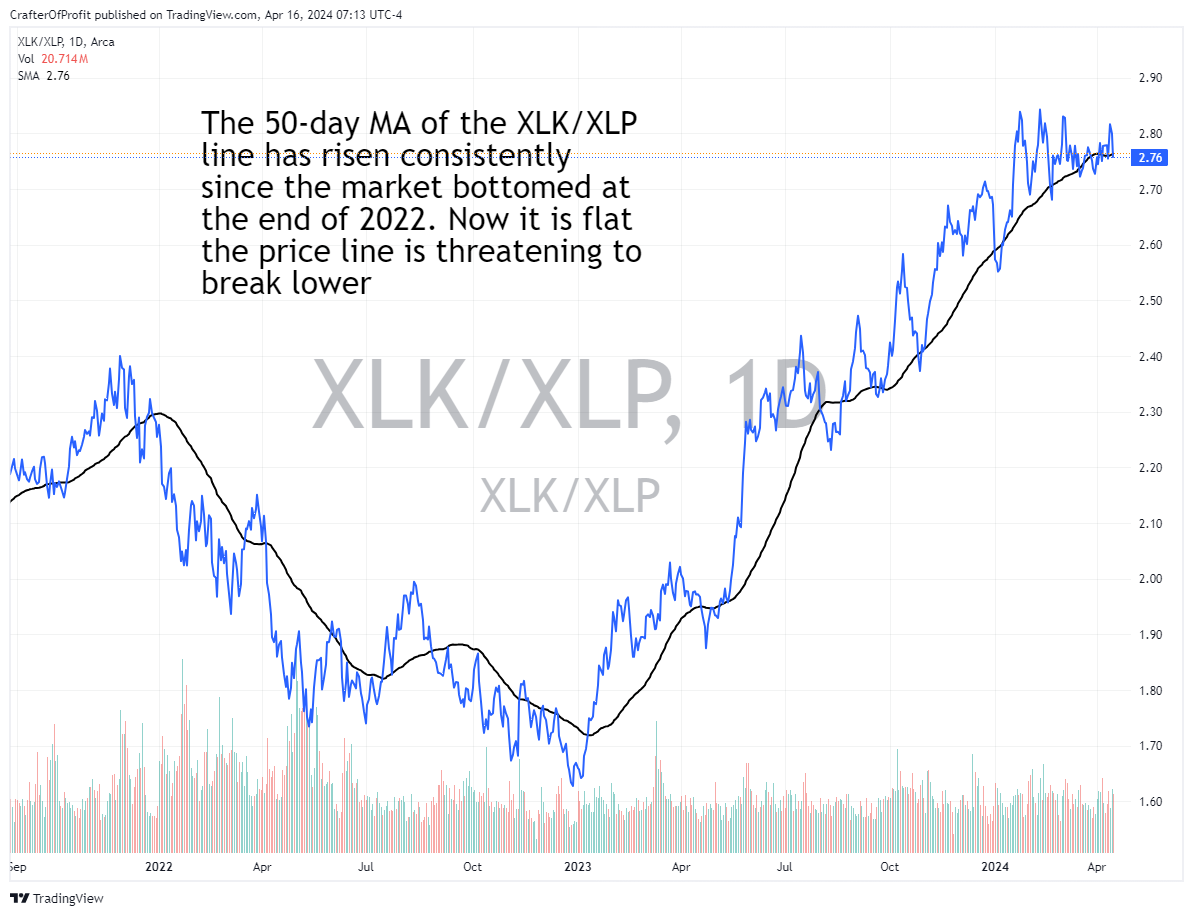

This is another ominous indicator for the market. And then we can see that investors are beginning to shift away from tech and into safety stocks.

I’ve got a chart below that takes the Tech ETF (XLK) and divides it by the Consumer Staples ETF (XLP). When the line goes up, it means that tech is outperforming. When the line goes down it means consumer staples are doing better as investors are looking for safety. And now the ratio line is threatening to break below the 50-day MA and that MA line is about to turn lower for the first time since the market bottomed.

So we should be very concerned right now.

But there is one thing that could change all this and send the market higher. And that’s earnings. Earnings season has just begun. And so far good earnings from the banks like JPMorgan (JPM) and Goldman Sachs (GS) haven’t been enough to hold up those stocks.

The two companies we should pay close attention to are ASML and TSM. These are market leaders which are enabling the manufacturing of bleeding edge semiconductors. They’re vitally important for the AI trend to continue. And if AI companies are going to regain their leadership and push the market higher, these companies need to report good earnings with a rosy outlook.

ASML reports Wednesday morning and TSM Thursday morning. We’ll get confirmation either way in a couple days.

Careful investing out there.