The Federal Reserve Is Making Inflation Worse

And raising rates could lead to higher inflation

I'll give away the punchline right away. A higher Federal Funds rate will not solve the inflation problem we face. In fact, it is likely to make it worse.

And a higher level of inflation will cause stock prices to continue lower. It has to do with how Wall Street values assets. They use the infamous discounted cash flow (DCF) model.

If you understand the adage "a bird in the hand is worth two in the bush," you understand the basis of a DCF model. Analysts project how much cash the company will earn in future years. But a dollar five years from now is worth less than a dollar three years from now... And that is worth less than a dollar today.

Wall Street "discounts" those future cash flows. And the higher the inflation rate, the more those future dollars need discounting. Making the estimated value of stocks worth less than in times of low inflation.

This is why everyone is following reading of the CPI, PPI, PCE, etc... They are looking for measure of inflation to go down. But we haven't seen much of a break in these numbers. And it is unlikely we will.

The Fed's Interest Raising Journey

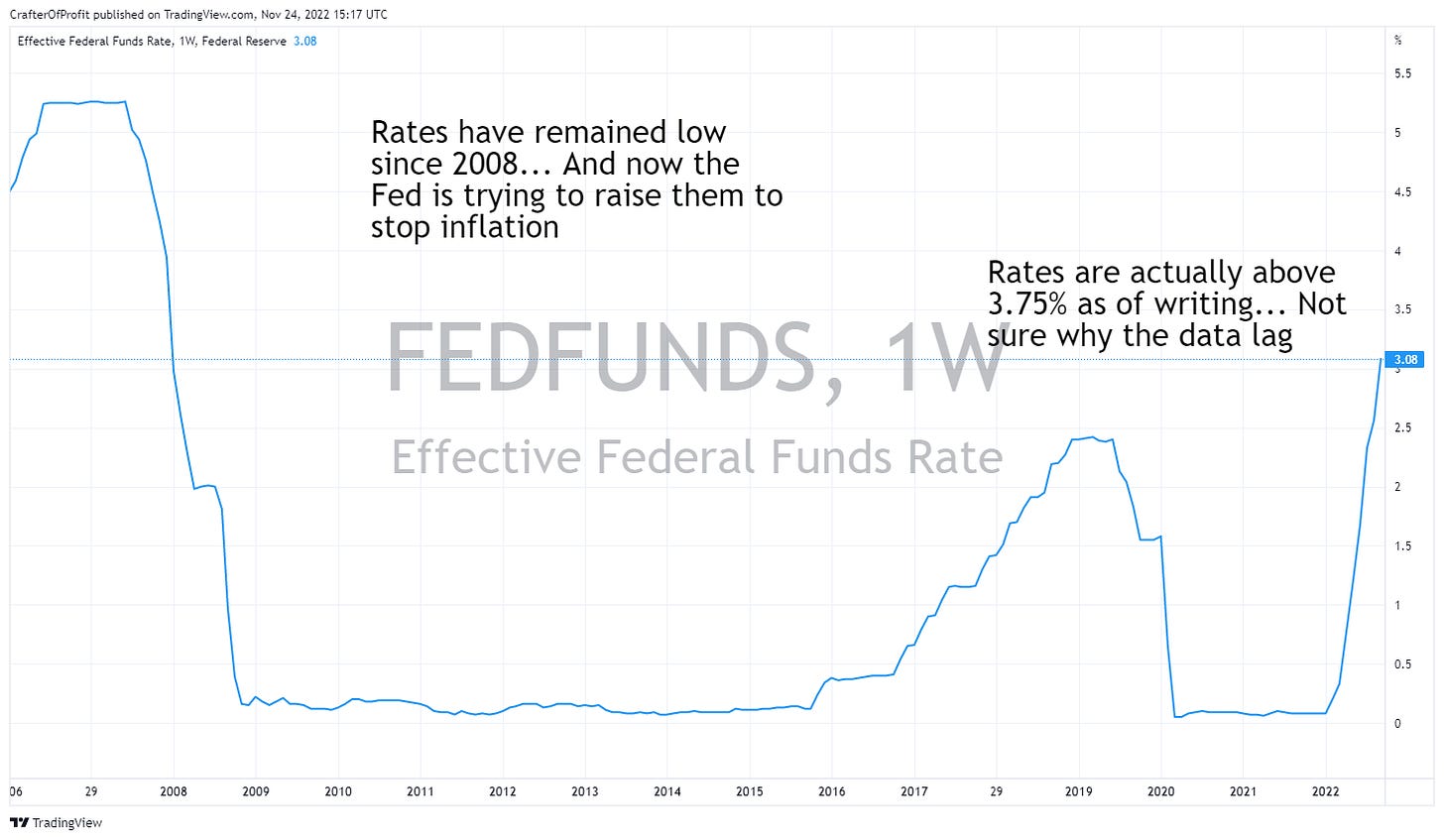

The Federal Reserve cut their Federal Funds Rate to 0% to help stave off the financial collapse in 2008 - 09. And rates have remained ever since.

As we can see rates have remained below the 2007 peak for the past 13 years. The Fed began raising rates in 2018 - 19. But they had to cut rates to help the economy when pandemic-induced lockdowns began in 2020.

And now the Fed has raised rates from 0% to 3.75%. Many thought the economy would crumble by now... And the Fed would have to reverse course. But that hasn't happened.

In fact, it's far from happening.

The Economy Is Running Hot

We are still at full employment.

Jobless claims are still low. That’s despite the massive layoffs we’re seeing at major tech companies.

Spending numbers are still high across the board.

The crux of the argument is that anyone who needs a job can get a job. And that gives people money to spend. And they will continue to spend… Sidenote: I think projections of weak holiday spending will be proven wrong. We’ll get a sneak peak starting next week with Black Friday and Cyber Monday numbers.

And then the one area we all thought we’d see moderate – housing – hasn’t.

Higher mortgage rates were supposed to kill the housing market. In October housing picked up 7.5% on an annual basis.[1] When people need a house, they’re going to get a house. And for those taking out a mortgage, they’re paying over a $1,000 a month more on an average house.

Money is still flowing through the system.

And here is what worries me…

Production is Declining

Just yesterday, the Producer’s Manufacturing Index (PMI) came in at a 46.3 – the lowest reading in a couple years. PMI measures business activity in the manufacturing and services sectors. Any reading under 50 means there’s a contraction.

So businesses are supplying fewer good and services than they were before.

Conventional wisdom says this is a good sign that inflation is dampening.[2] Here’s why they’re wrong.

It all comes down to basic economics – supply and demand. Demand remains high and people have jobs so they’re earning money. But we have less supply as businesses produce less.

High demand with lower supply means we will continue to see high inflation. In fact, it could get even higher.

This is what some economists call stagflation. An environment where we see higher prices with lower economic growth. I’ve thought we’d reach this point for years… And we’re finally here.

For The Fed’s Interest Rate Hikes to Work, They Must Destroy Demand

All the Fed can hope to do with raising interest rates is to slow down demand. Theoretically, higher interest rates should prevent businesses from expanding marginally profitable businesses. And by doing that, we’ll see fewer jobs and less money sloshing through the economy.

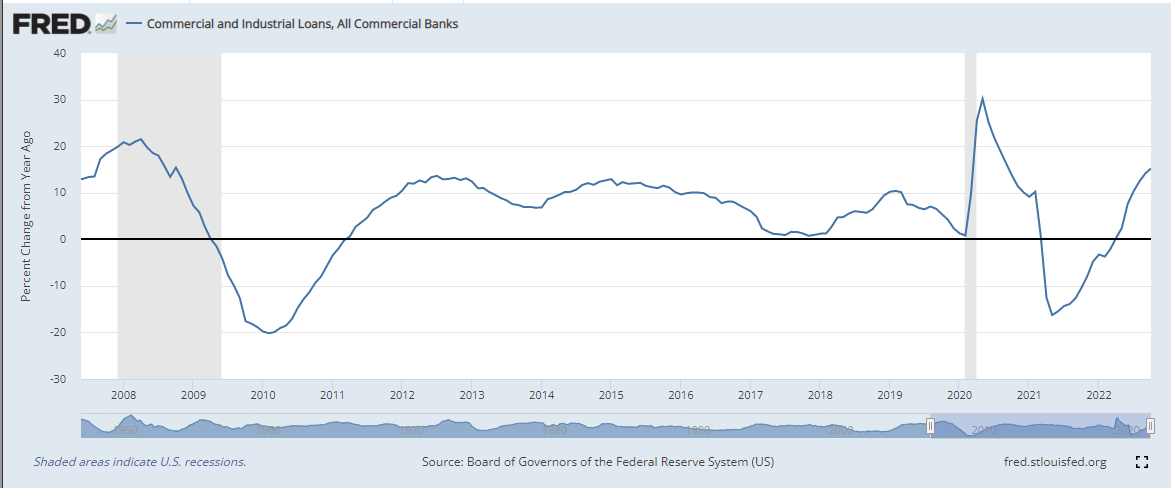

But as we can see, the Fed hasn’t slowed down the economy at all. And these higher interest rates haven’t stopped businesses from borrowing. As of October, business loan growth reached 15%. With the exception of weirdness in 2020, this is the fastest businesses have borrowed in 15 years.

And these businesses are still hiring people. And those people are still spending money.

We’ve all noticed this. If you go to a mall or try to get a reservation at a restaurant, it’s crowded. By me, cocktails are gong for $15 each and a salad will run you about the same – more if you add protein.

The Fed’s interest rate hikes aren’t destroying loan growth from businesses or individuals. But demand remains high.

But what’s happening, according to the PMI is supply is declining.

The Fed is chasing their tail right now… And all of this will just destroy the economy.

Current Inflation Stems from Supply Chain Issues

The current inflation comes from disruptions in supply chains around the world.

China continues its rolling lockdowns to prevent COVID from spreading. It’s not working, but they’re doing it anyways.

The Ukraine/Russia war will have disastrous impacts on the food supply chain. Immediately we see disruptions to wheat distribution in Europe and Africa. Next year, we’ll notice the lack of fertilizer leaving the region. And that will likely lead to even less food produced next year. It’ll be a vicious cycle.

And anyone trying to order appliances or get their favorite cut of meat will find themselves on a waiting list…. And once the time comes to purchase, prices will be higher than anticipated.

If the Fed and politicians were serious about reigning in inflation, they’d increase supply. They’d make the money available and cut red tape for private enterprises to increase the supply of things like dwellings, oil, and food.

But that’s not happening. And as long as this supply doesn’t increase, those with money will continue to pay up for the goods and services they want.

And we’ll continue to see inflation rise.

I’m convinced the Fed knows this. And they’re hoping they can destroy more demand than supply in this situation. They’ve chosen their path. They’re following the traditional playbook which says when inflation rises, interest rates should follow... Even though that’s not going to help this time.

But as they say, “it’s better to fail conventionally then to fail unconventionally.” They’re just doing what they’re supposed to do to save face.

That’s bad news for investors. It means we will see higher inflation… And we’ll see the Fed Funds rate remain high.

So we will continue to see volatile markets that trend lower. That means any rally we see is to be sold.

Many company’s stocks have never traded at cheaper valuation levels. But avoid these value traps. It’s likely they will trade even cheaper in coming months as inflation persists.

This makes holding stocks for the long-term very difficult. If you are doing that, make sure you’re ready to hold onto a company for at least three years. That could be how long it takes to get through this.

Or be ready to quickly take profits on short-term positions…

Barbell investors should already have most of their positions deleveraged. 80% of our portfolio, the barbell portion, should be in cash or short-term treasuries. Then the other 20% should be used to strategically make short-term investments.

That remains our strategy for the time being. Stay safe.

[1] https://finance.yahoo.com/news/u-home-sales-unexpectedly-rise-153351014.html

[2] https://www.reuters.com/markets/us/us-business-activity-weakens-further-november-sp-global-survey-2022-11-23/