The Fed Only Has One Choice – And What That Means for the Economy

Prepare your portfolios for the outcome...

Hey Folks - for most of the past year, this blog was for placing trades related to episodic pivots. That will continue. But I refrained from sharing my macro thoughts because it was a conflict of interest with my previous employer. But that’s no longer a problem. Hope you enjoy it.

"Just kick 'em in the rump a little."

That's the advice President Richard Nixon gave Federal Reserve Chairman Arthur Burns in 1971.

Nixon had a huge problem. Stagflation - a slowing economy with high inflation - gripped the nation. If something didn't change, his reelection chances were virtually nil. So Nixon called up the man he had recently appointed to lead the Fed.

Burns was to figuratively administer this kick to the Federal Open Market Committee (FOMC) during their meeting to set the Fed Funds interest rate.

This pressure, and perhaps Burns conservative political beliefs, got him to convince the Federal Open Market to lower interest in 1971. The FOMC took the Fed Funds rate from 8.7% at the beginning of 1970 to 4.05% by the beginning of 1972.

These drastic cuts were made to help stimulate economic activity. But all these rates did was ensure inflation would soar once the price and wage controls were lifted in 1973.

With these interest rate cuts Burns cemented his legacy as a patsy and likely the worst Fed Chairman of all-time. And he’s a cautionary tale for the current times. Current Fed chairman, Jerome Powell and the FOMC are steadfast not to repeat his mistakes.

Today we're going to talk about why the Fed only has one choice and what that means for the future of our economy.

The Fed Is Doing the Only Thing They Can

I know it's not cool to say that. Financial guys are supposed to blame the Fed for all the economic problems we face. But the fact is, the Fed only had, and still only has, one choice. And that's to raise rates and keep them higher for longer.

The Fed only controls monetary policy. That is policies related to the financial system. And despite what many believe, monetary policy does not impact inflation much, if at all.

For the entirety of the 2010s, we had “loose” monetary policy. This meant that interest rates were kept low, and the Fed was buying U.S. Treasuries. The Fed did this to try to stimulate the economy and prevent another 2008-like crash.

Skeptics said this low interest rate environment would lead to inflation. Maybe even hyper-inflation. As we can see in the chart below, that never happened. For an entire decade of low interest rates, inflation never seeped into the economy.

As we can see, inflation never got above 3% a year during that whole period. That should be all the proof I need to show to prove my point that loose monetary policy doesn’t cause inflation.

However, these low interest rates inflated financial assets. That why bond prices reached all-time highs and yields reached all-time lows. Bond yields even went negative, which meant investors were paying governments to borrow money.

Then in a search for yield, investors had to go into other assets. That’s why the stock market became the most expensive ever – people were looking for yield in dividend paying stocks. And why house prices rose to unaffordable levels. Housing prices rose as investors tried to buy houses for rental yield, more so than people being able to afford them. And for that reason, I consider houses a financial asset as well.

But the inflation of financial assets, never seeped into the real economy.

Inflation didn’t start until 2021. But the cause was not low interest rates.

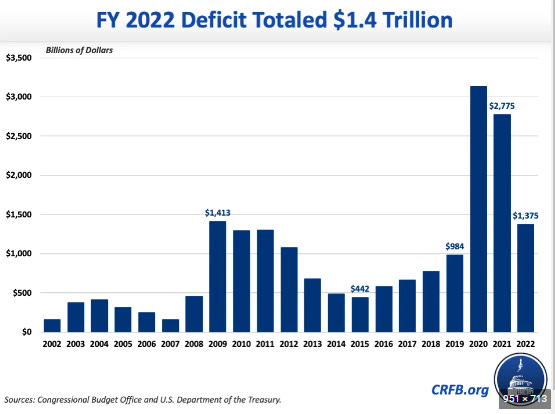

In 2020, the government took unprecedented actions around the world. They told people to stay home from work and produce nothing. But they’d still get paid. The government undertook massive deficit spending to try to not ruin the lives of millions of Americans. And we had the largest deficits on record.

When the government paid people to stay at home, many made more than when they were working. This policy increased the demand for goods. But production of goods plummeted because factories were closed. Economics 101 tells you only one thing can happen – prices must rise.

This is what caused inflation to soar. Not monetary policy, which had been loose for a decade. The first chart clearly shows inflation only began after the reckless fiscal policy coming from government.

If you want to look for a culprit in the inflationary mess, you have to look no further than your elected representatives in DC. And politicians have backed the Fed into a corner.

The Fed’s Only Choice Is to Try to Slow Demand Through Credit Contraction

If low rates were the goal, we could have them already. We just need the government to stop spending. The 2023 government fiscal year just wrapped up on September 30. We spent another $1.7 trillion that we don’t have.

If that wasn’t spent, we’d already be in a recession. U.S. GDP only grew by $1.5 trillion the past 12 months.

We ran a fiscal deficit that was about 5% of GDP. And it’s not a real surprise that inflation was about 5% for the year. Inflation and the percentage of deficit spending are very highly correlated in normal economic environments.

The only way to stop this fiscal spending from being inflationary is to suck money out of the system from other angles.

The main way the economy grows is with credit from the private market. This is when businesses take loans to build a factory to produce a good. That enlarges the economy. Or when someone takes a mortgage to build a home – productive assets grow.

So if the Fed wants to fulfill its main mandate to have a stable currency, they must raise rates to contract credit.

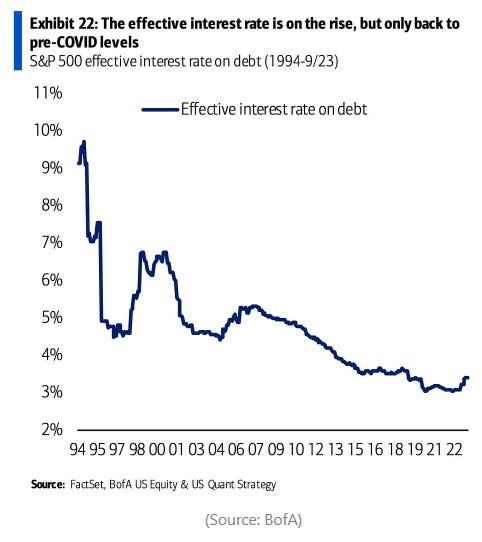

But here’s the thing – it takes time for higher rates to make their way into the economy. So any monetary policy changes will have a lagged effect. Many put the delay at 2 years. The reason is, not all debt gets refinanced right away. It takes years for company debt to mature and have to be reissued. Here’s a chart that shows the effective interest rate on debt is still low.

But this rate is ticking up… And we’re approaching the second year of tightening monetary policy. We should start to see some slowing effects hit businesses.

Prepare For a Credit Crunch

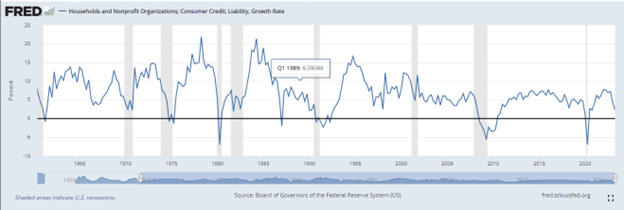

Anytime credit contracts so does the economy. We can see this in the following chart. Credit contracts whenever the line goes below 0. We can see recessions marked by grey boxes.

The only time credit growth went negative and it didn’t trigger a recession was in 1987. But those economic conditions led to the Black Monday crash when the markets fell 22% in a single day.

This naturally makes sense. When credit is growing, banks are creating new money to flow into the economy. People spend on goods and services they need. Businesses expand to meet demand. It creates a nice equilibrium.

When credit is paid back, money leaves the system and the economy shrinks.

And now with interest rates at the highest they’ve been in about 15 years, we can see credit growth slow… And it will go negative soon. A bad omen for the economy.

We are at the turning point right now. This is likely the end of the growth of excessive credit that’s propelled economic growth the past 14 years. Higher interest rates all but make sure of that. Many people and businesses will face tough times refinancing their low-cost debt when the time comes. And those that do, will see their payments soar. And they will have to cut back spending in other areas.

Be prepared. I have sold some of my weaker performing positions and hold a large cash position right now. There’s nothing wrong with earning a 5% yield in a savings account right now.

The stocks to hold are large cap growth stocks. These almost always are the ones that rise the longest. Stocks like Google (GOOG), Meta Networks (META), and Nvidia (NVDA) are good holds for now.

But hold these with tight stops. Eventually the market will turn. When it does, we’ll have to act quick to preserve our capital.