Special Midweek Update

The bull market can resume. All major U.S. stock indices made new highs after Jerome Powell whispered sweet nothing in investors ears on Wednesday. At the press conference after the FOMC meeting, he told the world that the Fed would take into account employment data when deciding on future interest rate policy. This was the first time he mentioned that. And with employment data getting weaker, investors took it to mean they would cut rates soon.

This sent the market higher. That’s why we said we should stick with the trend in Sunday’s letter. The market can continue higher for a lot longer than we think… Or for longer than makes sense. So don’t ask why, just continue holding stocks that were going higher.

One stock that wasn’t going higher was Aeva Technologies ( $AEVA). And since it closed below its 200-day moving average today, we should sell it for a slight loss.

But we’re going to replace it with another company today.

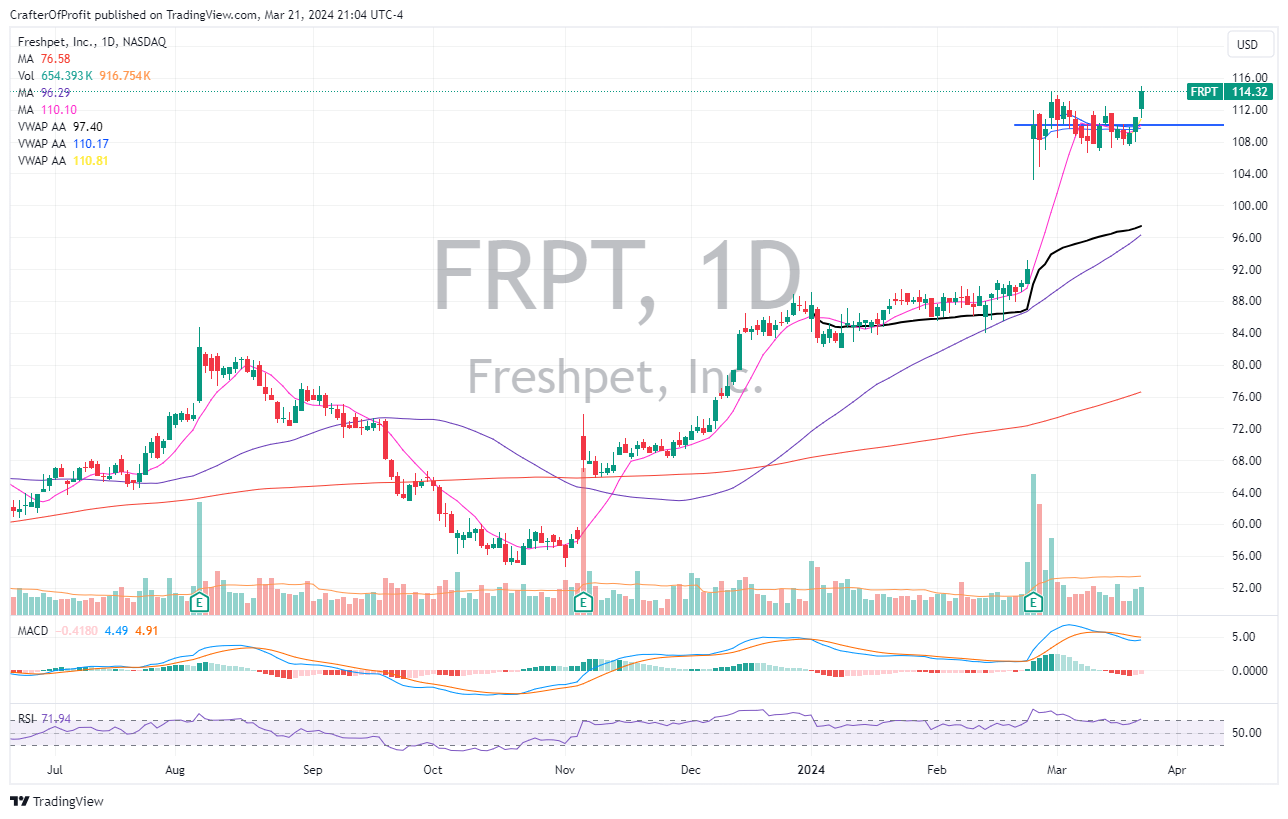

Freshpet ( $FRPT)

Freshpet produces natural fresh meals and treats for pets. They make their food with real meat, vegetables, and other natural ingredients.

And people must be treating their dogs to good food. The company’s revenues are soaring. Over the past five years, they’ve grown revenue by a CAGR of 32%. And in 2023, the company resumed expanding its gross margins after a tumultuous 2022.

This report sent FRPT to new 52-week highs a couple weeks ago. After forming a bull flag in the chart, the stock broke higher and did so on above-average volume. This is a strong continuation pattern which will likely lead to higher prices in the coming weeks.

So let’s buy a position in FRPT and we’ll use a tight stop at $106. If it breaks below that, our pattern is broke and we need to get out.

Happy Investing.