Soft Landings Are Made of Dreams

Never gonna happen

Hey Guys,

The holidays brought about another week of slow news. So there were no new episodic pivots to recommend.

The market finished the year strong, so our open holdings are performing well. So let’s keep on holding them.

The first week or two of the year are important in the markets. You get to begin to see what themes the big money is moving into this year. And it will probably be different than it was last year.

Although, artificial intelligence (AI) will still be a trend in the coming years, it probably won’t be the best performing one again this year. It’s unlikely Nvidia triples again this year…

And I think investors will begin looking forward to what sectors do well when the Federal Reserve begins cutting rates. Hint: it’s usually defensive stocks like consumer staples. A lowering of interest rates generally happens because economic activity is contracting. So investors like the stable earning of companies like Proctor & Gamble and Coca-Cola. Those predictable cash flows (and dividend payments) get scooped up by investors in times of uncertainty.

That trend is likely to play out this year. And I would expect we should continue to see a lot of volatility… Both to the downside and the upside. So be ready to pounce on big moves higher.

Another thing to talk about is how the Wall Street consensus seems to be calling for a “soft landing” and only a minor recession in the coming year or two. These people are dead wrong.

Soft landings never happen. Here’s why…

Soft Landings Are Made of Dreams

“US Economy on Track for Soft Landing”

This headline came across my desk the other day. It’s not a particularly exciting one, but I have a question for you. Which year did this headline come from? I’ll give you four choices:

a) 1929

b) 2000

c) 2007

d) 2023

Before we get to the answer, define a soft landing. It’s a time when the Federal Reserve raises interest rates to stop inflation without causing an economic recession and a large increase in the unemployment rate.

Did you decide yet?

Well, it’s a trick question. The answer is all the above. The particular article I’m referring to was from 2007 when the Dallas Federal Reserve branch said a soft landing was imminent.

But if you look back, you can see that before all these major downturns, supposed experts believed the economy was going to be just fine.

In 1929, popular talking head from Yale, Irving Fisher said if a correction came, it would look like a harmless slump. Oops – it led to the Great Depression.

That same year The World ran a headline saying “Banker Says Boom Will Run Into 1930.”

In 2000 we saw a headline reading “Making a Soft Landing Even Softer” in the New York Times.

And now in 2023, with just a quick Google search, we can see countless articles about the coming soft landing.

We’re watching history repeat itself. So the question everyone should ask themselves is this: Why is this time different?

I’d venture to say that this time won’t be any different, and we should prepare for what’s coming.

The Makings of a Soft Landing Call

Before almost every stock market downturn, economists and Federal Reserve officials believe the economy will avoid a recession.

Why does this happen? Because the data always looks the same…

The Fed begins raising rates because inflation is too high as economic growth surges. To achieve a soft landing we’d need to see the inflation rate come down to the 2% target.

The thing is that every time the economy slows, these conditions are met.

Every time we see the same reasons for these predictions. Here they are from 2007:

· Moderating inflation pressures and easing of other economic indicators suggested a soft landing.

· Housing market downturn and credit crunch are expected to have a limited impact on the broader economy.

· Strong business investment, exports, and consumer spending would cushion the economy.

· My favorite: The Federal Reserve is seen as likely to cut interest rates to support growth if needed.

This data gives people hope of a soft landing. And it tricks investors to getting back in the stock market too early. Here’s where soft landing predictions got people in 2000.

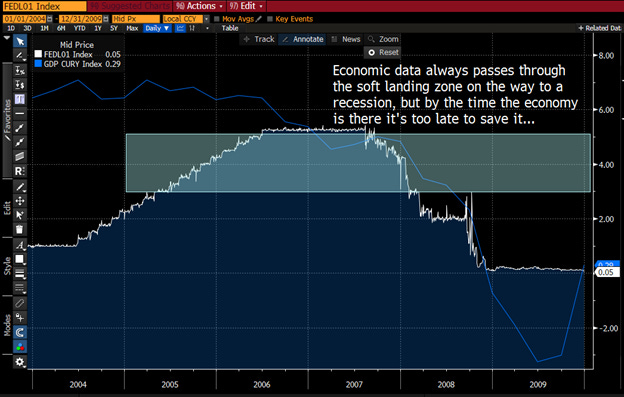

And here’s 2007.

We’re seeing the same talk now in 2023. Interest rates have risen, the economy is still growing, employment is still strong, and most people believe the collapse in commercial real estate won’t spread. So in their eyes, the soft-landing is here.

Why Soft-Landing Proclamations Continue to Happen

For businessmen, they believe they can steer their business through any economic climate. So good times are ahead for them.

For some investors, maybe they’re optimists. They like to look at the bright side of things as they see companies continuing to profit.

For economists at the Fed, it’s probably delusions of self-grandeur. These guys think they’re smartest in the world and can steer the economy.

But what everyone misses, is that the conditions for a soft landing will always occur on the way to a recession.

The economy will slow and inflation will subside on the way to economic disaster. It will look good for a brief period of time. As we can see in the chart below, after the Fed began raising its Fed Funds rate (white line), GDP growth (blue line) began moderating.

The economy looked primed for a soft landing in 2007, economists started predicting a soft landing, and investors got back into the market. But that was just a brief stop on the way to a recession.

Trying to steer the economy is tough. Former Fed Chairman Ben Bernanke said it best:

Making monetary policy is like driving a car, then the car is one that has an unreliable speedometer, a foggy windshield, and a tendency to respond unpredictably and with a delay to the accelerator or the brake.

And I’ve made the case previously that monetary policy has a limited impact on inflation and economic growth. I could even argue that it has no impact on inflation.

The way monetary policy works is that the Fed hopes that eventually higher interest rates will cause a slowdown in credit growth. And that will stall out the economy.

But it takes time for this to happen. Usually 2 – 3 years for the full effects of higher interest rates to be felt by borrowers. And even then, the results are spotty at best.

Because it takes so long, for an undetermined effect, it initially looks like the Fed policy isn’t working. So they jack up interest rates even higher in an effort to make it work. And they always end up overshooting the level at which they’d have to raise rates to create a soft landing.

And eventually these rates become restrictive and credit growth slows, or even contracts. That’s when recessions happen.

Recessions are Healthy

The truth is recessions will happen regardless of the current interest rates. The economy acts like a pendulum. It will swing to an extreme of growth, and then swing back to an extreme of contraction.

And these things happen out of necessity. During boom times many companies begin. They look like good businesses. But they’re not. It’s just high economic growth that makes them look good.

Some of these businesses aren’t the best run, they have bad business models, and they take on too much debt. These inefficient companies turn into zombie corporations.

Times of economic contraction weed out the zombie companies. They go bankrupt. It makes room for other companies, with better operators to come in and make the economy stronger.

It’s a necessary part of the economic cycle. And this part of the cycle is coming. Bankruptcies and delinquencies are on the rise in 2023. Consumer sentiment is in the dumps as the lower and middle classes struggle with high inflation.

We are confident the recession is coming. Don’t let the proclamations of a soft-landing trick you into thinking otherwise.

Soft landings only exist in our dreams.