Most Important Charts of the Week: September 12, 2022

Get your trading plan set for the week

The holiday shortened week was a big one for the bulls. And it looks like the markets want to go higher.

Although, we should take any market action last week with a grain of salt. People say the big traders take off Labor Day week to close out the summer. And then the big boys come back the following week.

So we’ll have plenty of action this week. I’d watch closely what happens Monday and specifically Tuesday. Those will give us clues as to what investors see happening in the coming months.

Remain flexible this week… The charts are saying we could see another bear market rally. But the real direction of the market starts now that the summer is over.

So without further adieu, let’s look at some charts.

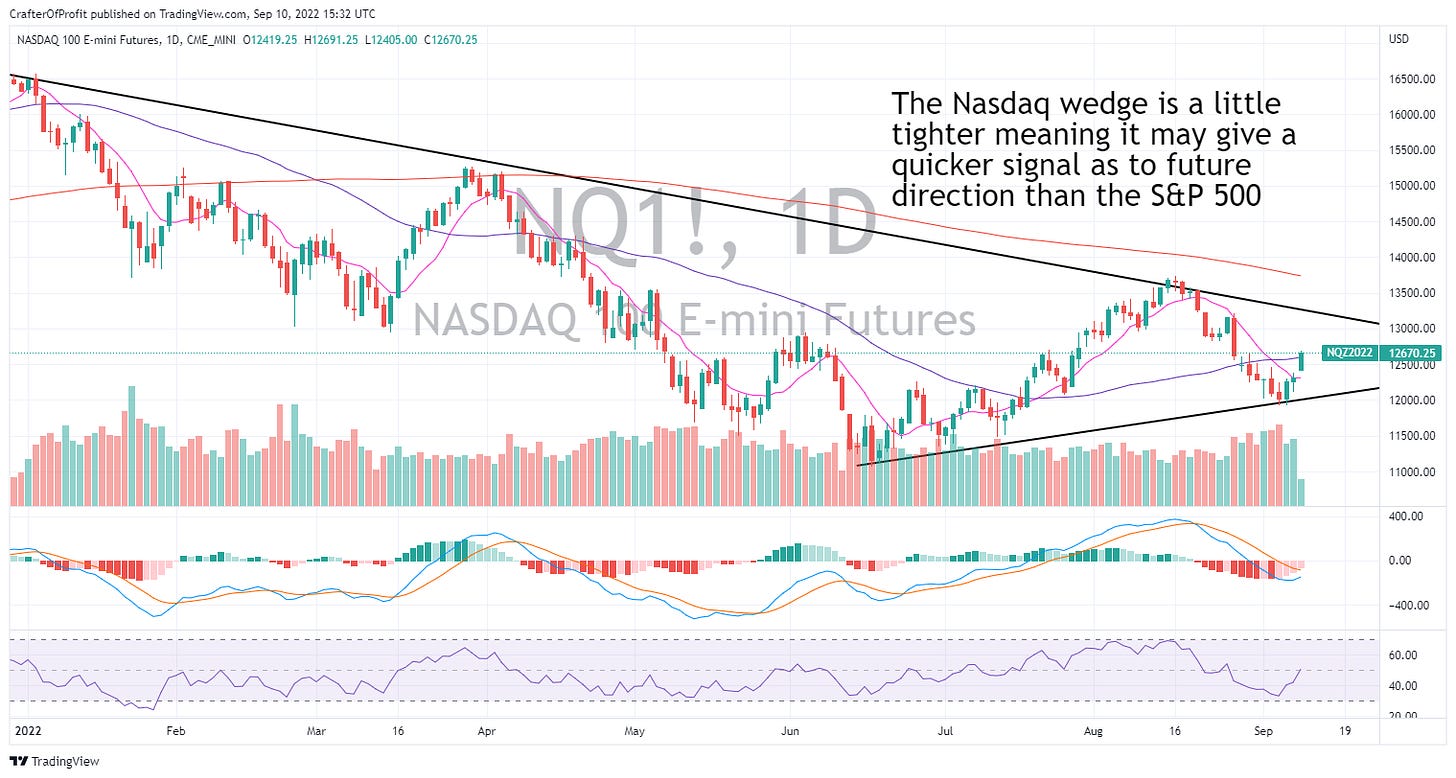

S&P 500 and Nasdaq Wedges

The strong price action from last week sent both the S&P 500 and the Nasdaq over their 50-day moving average. These were decisive moves on strong volume. This makes it likely the indexes will continue higher to the top of the wedge they are forming.

And the Nasdaq looks similar. The only difference is the Nasdaq is forming a tighter wedge pattern. This could make the Nasdaq the leading signal in the next big market move - higher or lower.

If we place any trades on Monday or Tuesday, I’d gear them to the long side.

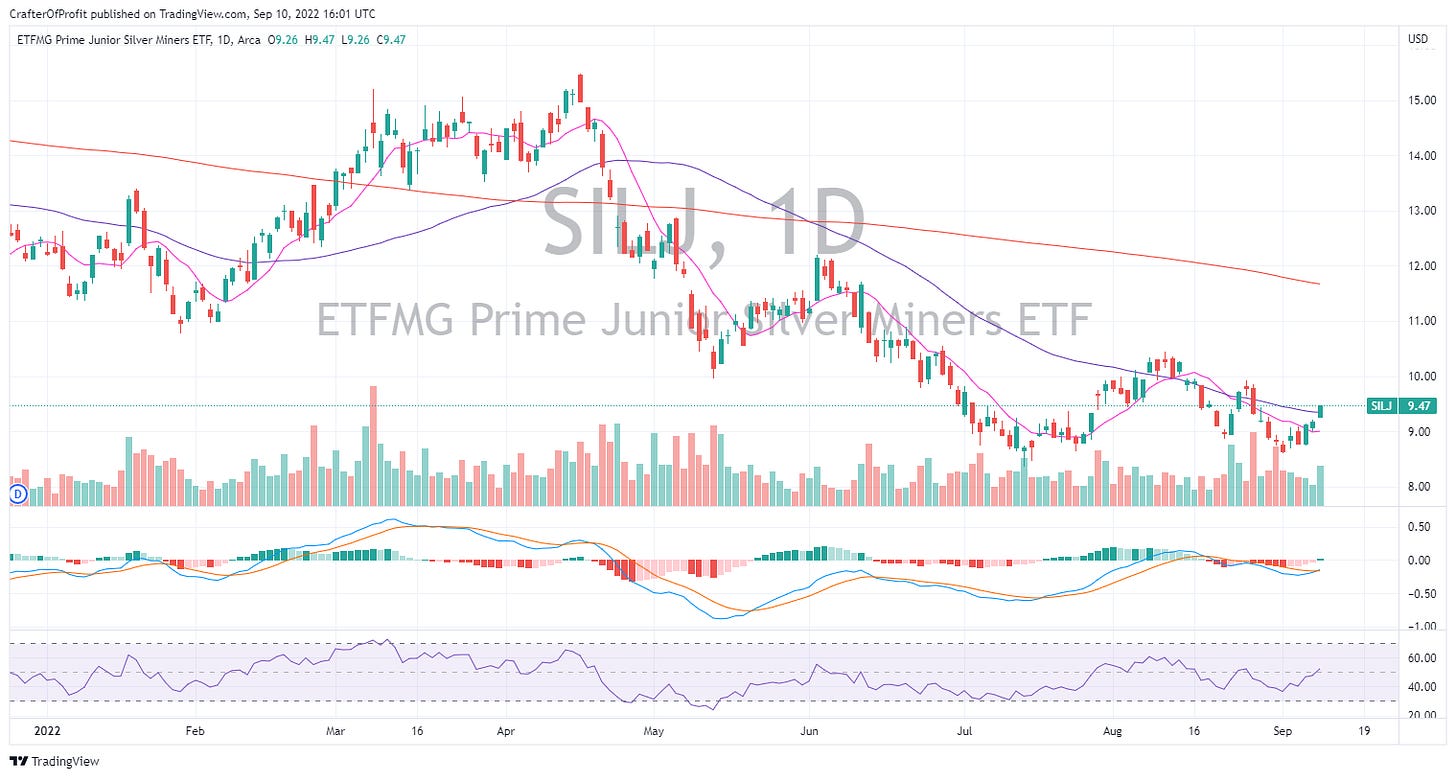

Gold is Carving out a Bottom

One sector in the market gearing up for a reversal is the precious metals. Specifically gold. In the chart below, we can see gold forming a higher low. And if gold can break higher, it’s likely we saw the bottom for the intermediate term.

Silver looks even better.

The junior miners are the way to play this trend. The Junior Silver Miners ETF ( SILJ 0.00%↑ ) look like they could easily rally 25% higher before they face resistance at the 200-day moving average.

But it’s not just dirt digging companies looking strong right now…

Solar Breaking Out

Solar stocks are also acting strong. Not only are these stocks near their 52-week highs, they just broke out of a pennant formation - suggesting higher prices on the horizon.

The Invesco Solar ETF ( TAN 0.00%↑ ) broke out of its pennant and headed higher. And it even tested the breakout line on Friday and surged higher.

This is strong price action. And the iShares Global Energy ETF ( ICLN 0.00%↑ ) also shows a similar pattern. Any stocks making up the top holdings in these funds are candidates for individual plays. Both Enphase ( ENPH 0.00%↑ ) and SolarEdge ( SEDG 0.00%↑ ) are the top two holdings in those funds. Enphase looks slightly strong to me.

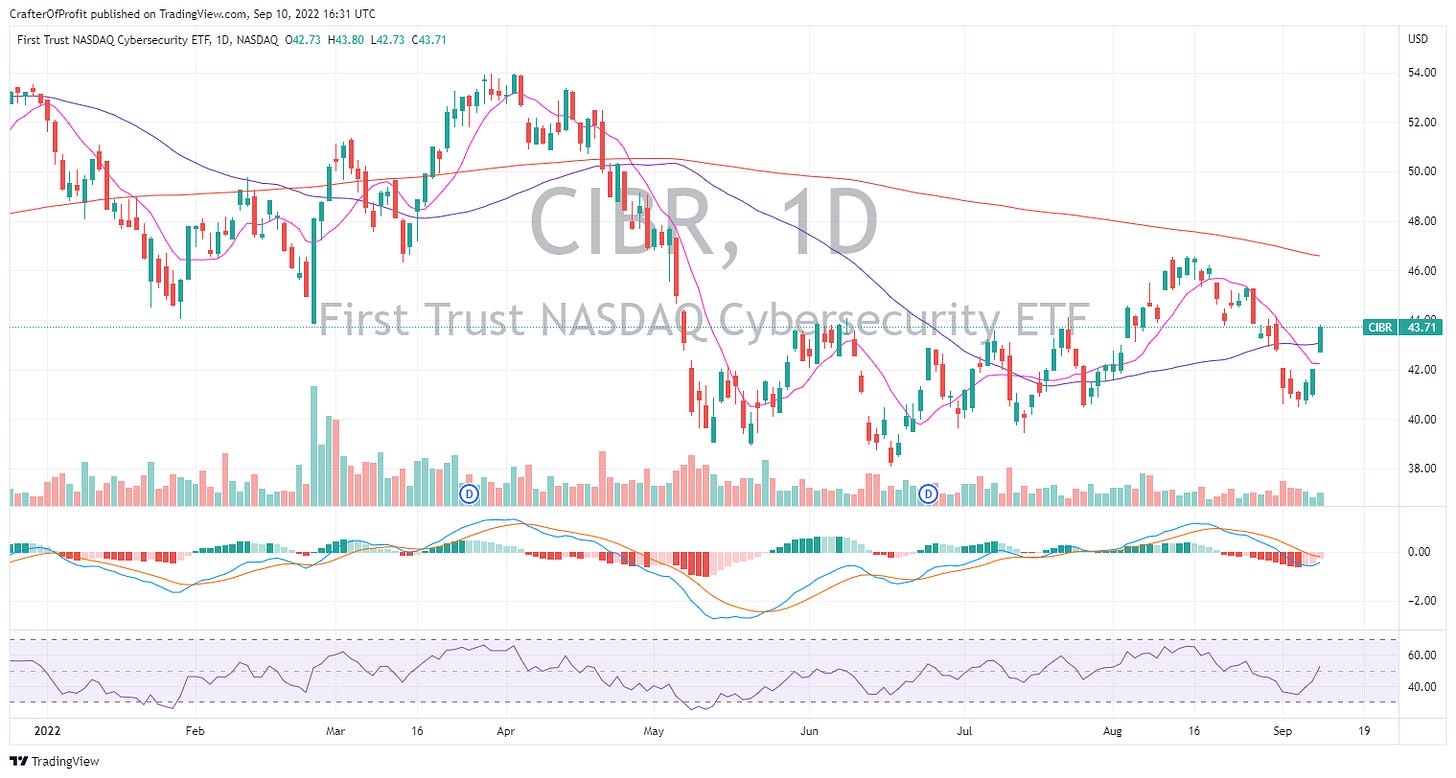

Zscaler gives Cybersecurity Stocks a Boost

Zscaled ( ZS 0.00%↑ ) reported earnings on Thursday evening and crushed their expectations. This sent the entire cybersecurity sector higher.

A chart of the First Trust Cybersecurity ETF ( CIBR 0.00%↑ ) shows a decisive breakout above the 10-day and 50-day moving averages on Friday.

This makes it likely we’ll see a retest of the August highs and the 200-day moving average in the coming week.

The strongest stock in the sector right now looks like Cloudflare ( NET 0.00%↑ )

NET is gearing up for a strong move higher in the coming weeks. This also looks like a position we could hold for the long-term as well…. But we’ll save the fundamental talk for another day.

These are the most important charts for the week. And we’ll learn a lot by following these charts.