Most Important Charts of the Week: August 15, 2022

Jumpstart your trading with these charts.

Welcome to the Most Important Charts of the Week. Here we’ll go over the charts you need to know to see to plan your trading for the week ahead.

We Need to Pay Attention to the Indices This Week

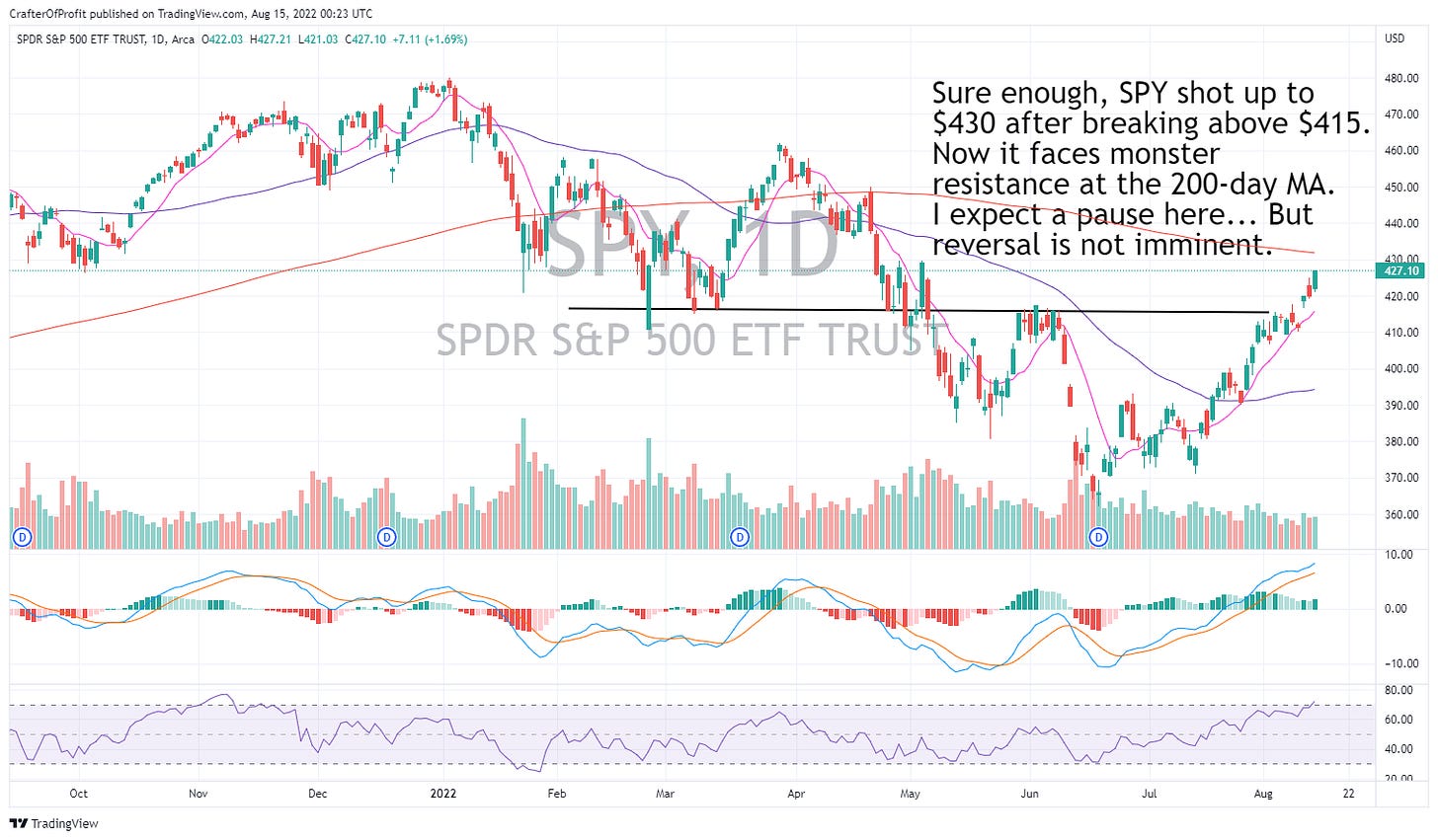

As we talked about a couple weeks ago, the indices were poised to break higher… And they did and are approaching the profit targets. So we should see a pause in the rally this week. But with trading we never know… I don’t see any signals of a reversal yet. But with resistance approaching, it’s important to watch for reversals and protect profits.

As you can see in the S&P 500 ETF ($SPY) chart, we are quickly approaching resistance.

The S&P 500 is within a percent of the 200-day moving average. And in bear markets, the 200-day tends to extinguish any rally that reaches it.

And the Nasdaq isn’t far behind…

The QQQs are within 3% of the 200-day moving average. But that’s close enough to consider taking profits.

Small caps will also face a major test this week… These bad boys are already knocking on the door of the 200-day.

I can’t over emphasize how important the 200-day MA is in bear market rallies. It would be incredibly bullish if we saw multiple indices break above it…. We’d see many bears turn into bulls at that point. And we’d likely see a flood of money head into the markets.

The One Factor That Could Push Stocks Through Resistance

And that is the dollar. The Dollar Index (DXY) is looking like it’s ready to breakdown. A lower (weaker) dollar generally pushes stocks higher.

The break below the trendline and the 10 and 50-day moving averages doesn’t look good for dollar bulls.

Typically a weaker dollar leads to good things in emerging markets stocks. And the Emerging Markets ETF EEM 0.00%↑ is reversing higher as we speak.

EEM looks ready to surge another 10% higher in the coming month or two. We’ll watch this one closely.

And another group poised to rally with the dollar weakening is junior gold miners. The junior gold miner ETF GDXJ 0.00%↑ had a great showing this past week.

Juniors jumped higher the past couple weeks and this chart looks great moving forward. And the thing I love about GDXJ is that this thing surges… We don’t even need to try to pick individual minors. The ETF moves enough for us to make big gains.

Random Thoughts

Industrials have surged this past month. And they continue to lead the market higher… But I worry that this move is overextended…

I wouldn’t press any large winners too much further right now. Nothing moves straight up forever.

And biotechs are finally moving higher. The SPDR Biotech ETF XBI 0.00%↑ has shown some impressive price action on high volume since the bottom in June. And the MACD continues making new higher along with XBI. Super strong.

If you’re still bullish on the market, picking up some biotech exposure will give you some extra alpha in the coming weeks.

What charts am I missing? What are you looking at? Let me know in the comments below.