Banks Are Telling Us the Credit Crunch Is Here

Wrote this a month ago, but still relevant

Hey guys,

I don’t have any new episodic pivot trades this week. It’s my fault - I no longer have access to my data provider where I could see all the potential episodic pivots from the past week. Now I can only see for the previous day.

While not ideal for this week, it will force me to look at new setups everyday for you. And it will likely lead to mid-week updates for new positions.

As a consolation prize, here’s an article I wrote during earnings seasons. It’s still relevant today. And it shows why I’m leaning bearish going into 2024.

Alexander Fordyce single-handedly set off the first international credit crisis.

In 1772 Fordyce was a partner at the London banking firm Neale, James, Fordyce, and Down. He built his bank into a speculative powerhouse. He was the big earner for the partnership. At the time, the bank was flush with deposits… And Fordyce didn’t want the cash sitting around. So he put it to work speculating on price movements.

His boldest move was a large bet against the East India Company stock. He was hoping to profit from a decline in price. However, the stock rose. And Fordyce needed to come up with 300,000 pounds to cover his debts. He didn’t have that, so he fled to France while his partnership failed.

This failure led to the credit networks dissolving. And depositors, smelling trouble, went to withdraw their money. By the time the dust settled over 500 banks in London and 30 more across Europe failed.

It even spread to America as colonial planters relied heavily on British credit to finance their planting. Without new lines of credit these farmers struggled to repay the loans and couldn’t produce as many goods. This strained relations between the colonies and Britain… And set the stage for the impending American Revolution.

Since then, every couple of decades the world has an international credit event.

Credit expands, speculative nonsense happens, and a big bust ensues to reset the system. The most recent one being the Global Financial Crisis in 2008.

Now we have another credit crunch on the horizon. And it’s just about to pick up into high gear.

Earnings Season Is Here

Any analyst worth his weight should be pouring through all major earnings releases. It’s here we find out, in real-time, what businesses see in the future. And if you dig deep enough, you can find little nuggets of gold when it comes to predicting the future in stocks and the economy.

The biggest nuggets this earnings season is coming from the banks. They’re signaling a major shift is taking place in consumer spending and the markets.

Both the tone of management and how investors are reacting to earnings have changed. And if you don’t understand what this means, you will end up losing your hard-earned savings.

The Middle Class is Maxed Out

This is the message coming from all the financials. It’s not just a one-off company performing poorly. Just about every bank and credit card issuer is telling us this. Here’s Citigroup CEO Jane Fraser:

“When I think about the [credit] cards business, it's very much driven by the affluent customer. The affluent is accounting for almost all the spending growth. And that's similar to the numbers we saw coming out of the Fed. The excess savings sitting there are now primarily with households of over $150,000 of income. And it's down in the rest."

She’s saying all the spending growth is taking place in households with over $150k in income. That’s only 20% of U.S. households. The other 80% are spending less at the same time their savings levels have shrunk.

We’re seeing this sneak into luxury goods as well. LVMH CFO Jean-Jacques Guiony touched on this topic during his earnings call. He said U.S. aspirational customers – those who think they are rich but are not… and probably shouldn’t be buying $10,000 bags – have experienced “some pressure in the first half of the year.”

Going back to financials, JPMorgan’s CFO told us that spending growth was flat this year. And that “cash buffers continue to normalize to pre-pandemic levels with lower income groups normalizing faster.”

They’re telling us that poor people have spent all their “stimmy” checks and extra unemployment they received during the pandemic.

After Savings Runs Out People Turn to Credit

And turn to credit they have. U.S. credit card debt just reached all-time levels over $1 trillion. This growth in credit keeps the economy going for a little while longer. But all credit does is drive demand forward a bit. Eventually, credit stops growing and contracts. And that’s when recessions happen.

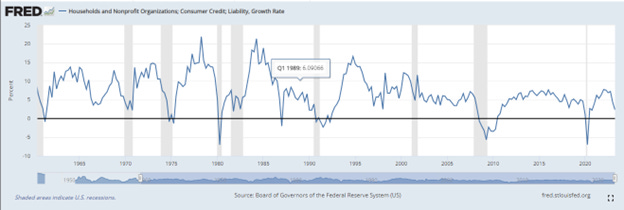

I’ve shared this chart before, but the chart of credit growth is one of the most important charts in finance right now.

Anytime credit contracts, the economy enters a recession. Look at that sharp decline this year. And credit growth has all but stalled out with 8%+ rates on mortgage and car loans. They average credit card interest rate is over 22%. I predict this line goes negative by the time we see fourth quarter data reported.

Wells Fargo CEO Charles Scharf gave a huge warning when he said:

"Average commercial and consumer loans were both down from the second quarter as higher rates and a slowing economy have weakened loan demand, and we've continued to take some credit tightening actions."

Not only are people and businesses asking for fewer loans, banks are tightening their lending standards. This is bad news for the economy.

But banks have a reason to be tightening those lending standards…

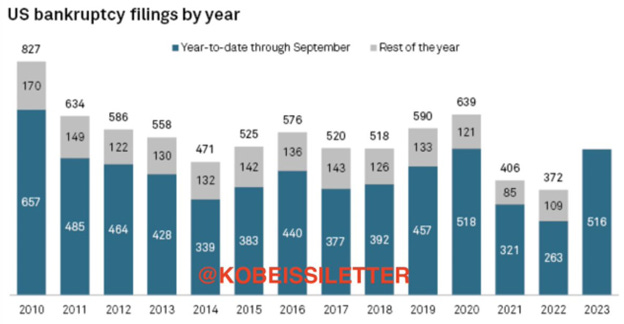

Bankruptcies Tick Up

After every period of credit growth, we see an increase in bankruptcies. It is the natural order of things. These bankruptcies need to happen to clear all the malinvestment from the previous cycle. It gets rid of the zombie companies and makes room for new, more efficient companies.

This happens in nature too. For instance the practice of fasting has become popular as it allows for autophagy to occur in our bodies. That’s when the body breaks down and reuses old cell parts so your cells can operate more efficiently. Out with the weak.

And we’re beginning to see bankruptcies make their way through the system. Here’s a chart of business bankruptcies. The blue bars record the amount of bankruptcies through September for each year.

Very few years in recent memory have seen as many bankruptcies as we have so far in 2023.

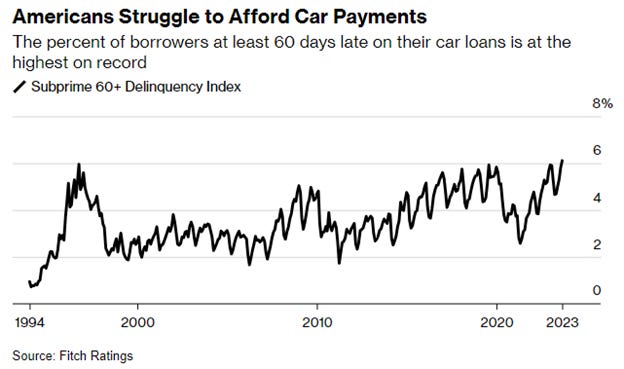

It’s not any better for individuals. Bloomberg recently ran a piece showing that subprime car loan delinquencies have surged to record high levels.

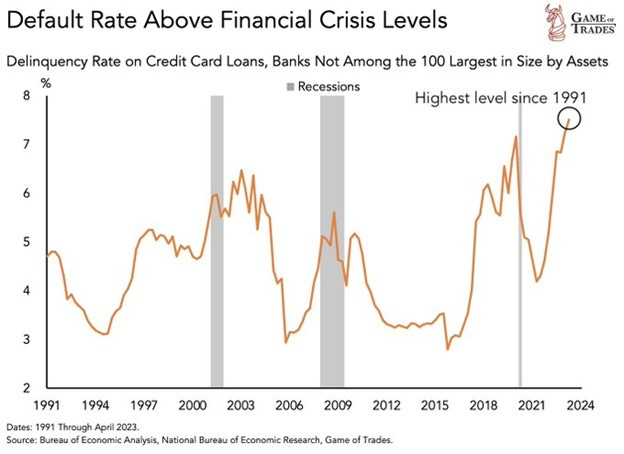

This alone may be just a microcosm, but credit card delinquency rates from small banks are surging as well.

People, especially those in the low and middle classes are about have their credit lines cut off. And with that, their spending will diminish.

A Story As Old As Time

This is just the credit cycle playing out as it has played out many times before. And the result is always the same – economic recession and falling asset prices.

We know this will happen. It’s just a matter of when. And the banks are telling us it’s now.

And as we’ve talked about, this credit event will cause a major catastrophe. With inflation remaining a problem, the Federal Reserve has no choice but to keep rates high. And they won’t be in any hurry to cut. Chairman Powell has already told Wall Street to expect a “period of below trend growth.”

We haven’t seen that below trend growth yet. And for the first time in over 40 years, we’re going go through a recession and be unable to lower interest rates.

Interest rates are the price of money. And money is now very expensive. Credit won’t be able to come in and save the economy this time.

One company that will struggle the most in this environment is Credit Acceptance Corporation (CACC). This company is known for originating subprime vehicle loans… And also for predatory lending practices.

Last quarter they had to increase their provision for credit losses to $250 million. That was nearly double what Wall Street expected. That’s just the beginning of their problems as subprime consumers are doing worse now than in the second quarter.

They report on Monday, and I expect a horrendous announcement from them.

Update: CACC’s earnings were terrible, but the stock has recovered in the market rally - setting up for big short next year…